The TSX today is no longer in market correction territory, with shares down about 8% as of writing from 2022 highs. It has some Canadian investors wondering if now is the time to seek out growth stocks — specifically, cannabis stocks.

Why cannabis stocks?

There are a lot of growth stocks to consider, so why cannabis stocks? There are a few reasons, and not all of them are reasons to invest. There’s the recent history in the minds of Canadian investors. Back in 2017 and 2018, shares of cannabis stocks took over the market. You could make thousands sometimes overnight from these companies. And everyone wanted a piece.

But what’s also in the mind of investors is the fall that happened quite literally as soon as Canadian federal legalization came out. Since then, shares have fallen lower and lower, with some of the biggest darlings of the cannabis industry slumping from almost $100 to single digits.

So, why now? Attention is now on the United States, with the potential for U.S. legalization a real eventuality. While cannabis companies hoped it would happen sooner, it will happen eventually — even if that means going state by state.

This has investors seeking out cannabis stocks interested yet again in the Canadian companies that will need to meet the demand for U.S. production, a potential US$100 billion industry. So, if that happens, where should Canadians invest?

Go big or go home

While large doesn’t necessarily mean safe, if you’re looking at cannabis stocks then I would consider how large the company is. Does it have the funds available to keep itself running, with methods of cutting back if we continue through this trying time? Or is it simply one of those popular cannabis stocks from way back that could go under at any moment?

In this case, your list should be quite short. And if you’re simply wanting to dip your foot in, then I would look at Tilray (TSX:TLRY)(NASDAQ:TLRY) and Canopy Growth (TSX:WEED)(NASDAQ:CGC). Both companies stand the chance to become the largest cannabis producer in the world. And already both have a huge setup in both Canada and the U.S.

Tilray stock or Canopy Growth stock?

But here’s the thing: Tilray stock has been profitable in the past, whereas Canopy Growth stock has not. Tilray stock recently reported record revenue, up 22% year over year during its recent quarter, but a net loss of $457.8 million after write-offs. Some of this came from the deal to buy $155 million in convertible debt from cannabis producer HEXO and acquire 48% of the company.

However, Tilray stock also isn’t focusing just on the U.S.; it is expanding its European operations in hopes legalization spreads across the pond. This is in stark contrast to Canopy Growth stock, which remains focused on acquisitions in the U.S. coming to pass with legalization and expanding its legal BioSteel operations.

Yet in terms of cash on hand, Canopy Growth stock still trades at a $2.1 billion loss, with $1.7 billion from a goodwill writedown on operations. It pushed its deadline to become profitable as well to 2024 from the end of 2022 and has made major cuts as shares fall.

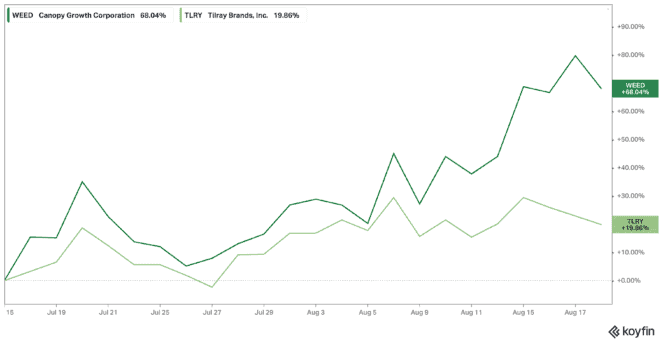

But as the market rebounds, it’s one of the cannabis stocks seeing growth, which is up an incredible 70% in just a month! That’s compared to Tilray stock, which is up 19% during the same period. This may be to do with Canopy Growth stock announcing it’s aiming to focus on premium cannabis products with the flood of competitive pricing on non-premium cannabis.

Foolish takeaway

There is one thing that Canopy Growth stock does have over Tilray stock, and it’s a major backer. Constellation Brands invested $5.2 billion in the company — the most of any of the cannabis stocks, including Tilray stock, despite some major partnerships. Constellation could have backed out with all these drops in the share price; instead, it has put its chosen leaders at the head of Canopy. Yet, even still, without U.S. legalization, both of these companies could have a rough road ahead.