Earning passive income as an investor in Canadian real estate is far from easy. If you want to buy a residential rental, vacation rental, or commercial property, there is a lot of work involved.

Firstly, you must complete a rigorous due diligence process on purchasing the property. You need some serious upfront capital to buy any property these days. If you are looking for financing, the bank or lender is going to require a lot of details and scrutinize the deal.

Many first-time landlords don’t calculate the “time factor” in their investment

Secondly, once you own the property, there is a huge amount of management required. Many first-time real estate investors don’t realize how much work it can take to find tenants, draft leases, maintain/repair the property, and collect rents.

Often, landlords make the mistake of not factoring the “time factor” into managing an investment property. This can ultimately have a negative influence on your total returns and your peace of mind. The reality is, being a landlord in Canada is hardly a passive way to earn income.

REITs are a great way to earn relatively easy passive income

Fortunately, there is one way you can truly be a passive landlord and earn very attractive capital and income returns. It is through the stock market. Through real estate investment trusts (REITS), investors can buy a stake in a large portfolio of high-quality properties in pretty much any market segment you are interested in.

There are REITs with a focus on healthcare, retail, grocery, hotels, retirement homes, apartments, and industrial properties. You can pick one, or you can own a combination of these different REITs.

The great thing is, they already have very qualified managers that are experienced at acquiring and managing properties. Generally, they also have a lot more capital flexibility to buy high-quality assets. Given this, many top REITs pay generous monthly dividends for passive income as well.

Be a carefree landlord with this top TSX REIT

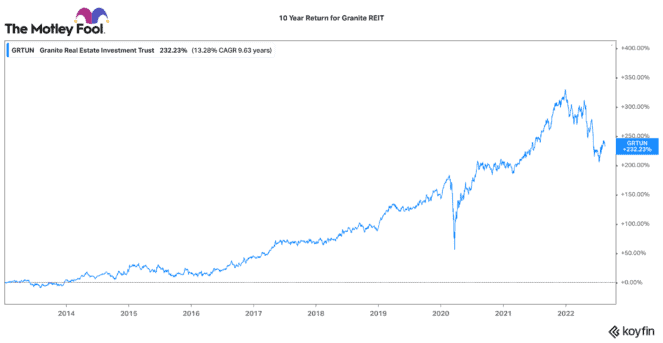

All in all, if you want to be a care-free landlord, owning REITs is a great alternative. The best news is that you can often buy REITs on the TSX at a discount to their private market value. In fact, one very high-quality REIT that trades at a bargain today is Granite REIT (TSX:GRT.UN).

Granite owns a large, diverse portfolio of logistics, manufacturing, and industrial properties across North America and Europe. Given e-commerce and on-shoring trends, Granite has been seeing very robust demand for its properties. In fact, the REIT is expecting 20-25% rental rate growth on new/renewed leases next year!

This year, the REIT is expecting to grow its funds from operation (FFO) (a key profitability and cash flow metric) by over 10%. Given a large development pipeline, it could grow just as much next year. This should support future dividend increases. The REIT has grown its distribution by over 4% annually since 2012.

Earn a monthly passive-income stream and some nice capital upside

Today, this passive income stock earns a 3.8% distribution return on your cost (yield). If you put, $20,000 into this stock, you would earn around $63.33 a month.

After a 24% decline this year, Granite trades at a very attractive price of $80.14 per unit. That is a nearly 12% discount to its private market property value. It also trades at a steep discount to its American and European industrial peers.

Despite economic fears, this REIT continues to perform very well. Yet the market doesn’t recognize it. Consequently, lazy landlords looking for passive income and potential capital upside can benefit by buying this stock and holding it for a recovery.