Beginner investors might find buying stocks very intimidating at first. I mean, the stock market can admittedly be a scary place. But it doesn’t have to be that way. With a little planning and strategy, your first experience with investing can be a smooth one. Read on, as I go through some key considerations for any beginner investor as well as three top stocks to buy now to start your investing journey off right.

What are your goals?

So, first of all, let’s review your goals. Maybe you’re just starting to save for retirement. Or maybe you want an immediate extra source of income. Either way, you surely want to protect your money AND grow it as much as possible.

Next, let’s think about the risk/reward tradeoff. Simply put, this tradeoff states that there’s an inverse relationship between risk and reward. This means that the higher the risk of an investment, the higher the potential reward. It also means the higher the potential downside or losses. So, we can see that a big part of investing is deciding what level of risk you are comfortable with. Only you can decide this.

Fortis: A safe, predictable stock for peace of mind

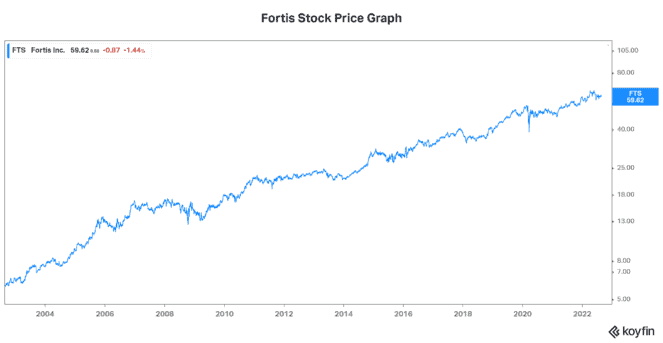

Many beginner investors are usually understandably nervous to dip their toes in the market. For those investors, Fortis (TSX:FTS)(NYSE:FTS) offers predictability, stability, and peace of mind. This is a function of its business. As a leading North American regulated gas and electric utility company, Fortis benefits from a business that supplies essential needs that are insensitive to economic fluctuations.

But don’t mistake all of this to mean lacklustre returns. In fact, it’s just the opposite. Fortis shareholders have actually done really well over the long term. This means many decades. The stock has risen over 380% in the last 20 years. Also, its dividend has grown for 48 consecutive years. This dividend has added another consistent layer of annual returns for Fortis stock.

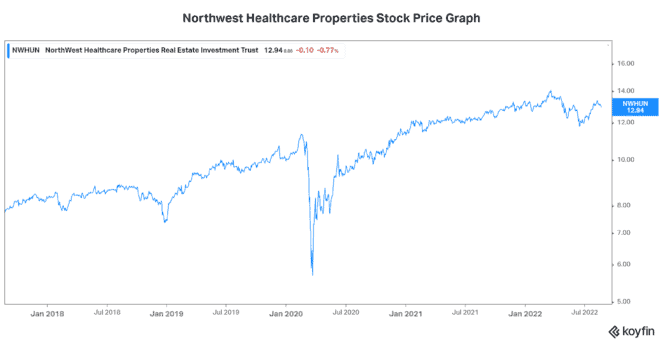

Northwest Healthcare REIT: A top dividend stock for passive income

For those beginner investors that are looking for an immediate income supplement, NorthWest Healthcare Properties REIT (TSX:NWH.UN) can help. NorthWest is Canada’s largest non-government owner and manager of medical office buildings and healthcare real estate. Currently, NorthWest yields a very generous 6.2%. This makes it a reliable source of income for investors that are seeking a passive-income stream.

But NorthWest is an attractive dividend stock for reasons beyond its attractive dividend yield. First of all, NorthWest’s revenues are largely inflation indexed. Needless to say, this is a very attractive feature, especially in today’s environment. Secondly, NorthWest is attractive, because it’s benefitting from the growth in the healthcare industry. This industry is supported by the aging population — a trend that’s accelerating. These factors make NorthWest one of the top stocks to buy right now.

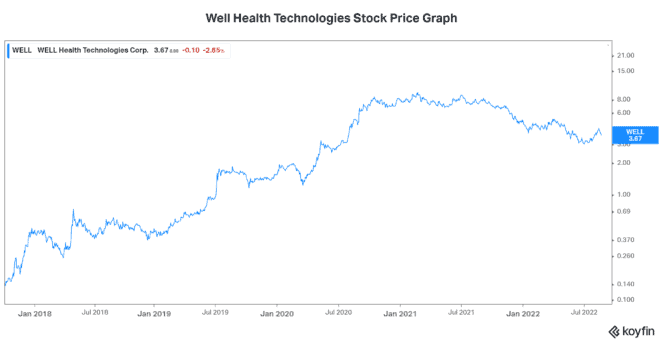

Well Health Technologies: A higher-risk, higher-reward stock

Well Health Technologies (TSX:WELL) is an omni-channel digital health company. It’s driving the long-needed digitization of the healthcare system at a time when increased efficiency and productivity is most sorely needed. This is because the healthcare industry has been under unprecedented strain. Thus, anything that can improve things is certainly very welcomed.

While Well Health Technologies has a business that I believe is set up for success, it’s in the early stages. Because of this, the company is currently reporting net losses. This makes sense and is typical. I mean, it takes a lot of investment to get a business off its feet. But this is what makes Well Health a higher-risk, higher-reward stock.

Mitigating this risk, we’ve got Well Health’s cash flow situation, which is a different story. This is where we can see the success and the potential. The company’s recent quarter saw record cash flows and record revenue growth. The business is booming, as the healthcare industry finally steps into the digital age, along with the rest of the world.

If you’ve made the decision to make some room for some higher-risk names in your portfolio, Well Health Technologies stock is a good option.