Dividend stocks can help our financial situation significantly. Monthly dividend payers are even more helpful, as the timing of the dividends matches the timing of most of our expenses. In short, they supply us with regular, consistent income when we need it most.

Every month, our expenses pile up. Here are two monthly dividend payers to boost your monthly income.

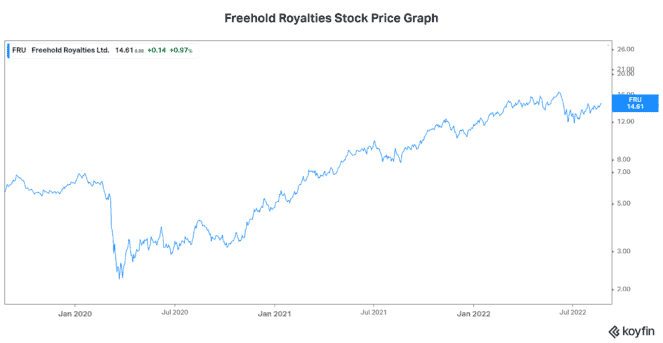

Freehold Royalties: A 7.4% yield makes this dividend stock a top buy

Freehold Royalties (TSX:FRU) is a Canadian oil and gas company that’s engaged in the production and development of oil and natural gas. Its dividend is on the rise AND it’s paid monthly. Today, it’s yielding well over 7%. Since the start of the new oil and gas up-cycle, its dividend has increased 430% to the current $0.32 per share.

The oil and gas industry is experiencing good times today. Oil prices have risen 36% in the last year. Crude oil has even hit above $120 this year, as supply/demand fundamentals have become very supportive of higher prices. Likewise, natural gas prices have skyrocketed. They’re up 138% versus last year, as natural gas fundamentals have become increasingly bullish.

What this means for Freehold Royalties is more royalties. Since the company simply collects revenue royalties, it is sheltered from many of the risks that other energy companies face. For example, Freehold is not responsible for any operating costs. This means that inflation can’t affect its income. Also, Freehold is not responsible for exploration costs. This means that exploration costs and failures can’t affect its income either.

All of this results in an energy stock that has exposure to upside in a way that limits downside risk. In its latest quarter, net income increased over 430%. Similarly, operating cash flow more than doubled. These results have enabled Freehold to increase its monthly dividend significantly. Last quarter, the dividend was increased 140%. As oil and gas prices remain high, we can expect more of the same in the coming quarters. This makes Freehold one of the best dividend stocks in Canada for monthly dividend income.

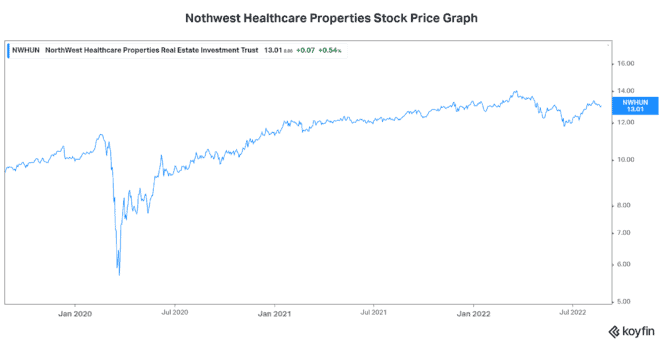

Northwest Healthcare Properties: This 6%-yielding stock just got more attractive

As far as monthly dividend payers go, Northwest Healthcare Properties REIT (TSX:NWH.UN) is top in its class. There are two defining characteristics of this stock that make it so. The first is the fact that this REIT owns healthcare properties. These properties are immune to economic shocks. They’re also benefitting from a strong growth runway ahead. This is because the population is aging. This trend means that healthcare properties are in high demand.

The second characteristic that makes Northwest Healthcare Properties a top dividend stock is quite simple: its revenues are inflation-indexed. This means that they cannot be hit by rising inflation. In a time where inflation is rising rapidly, this is an especially attractive characteristic. It means that the company’s revenue is safe. It also means that its dividend is safe and reliable.

For investors that are looking for that extra monthly income, these are the reasons to consider Northwest Healthcare Properties. Today, the stock is yielding more than 6%. Its growth continues, with $1 billion in recent acquisitions further strengthening its global portfolio. This will enable the company to continue to grow and provide investors with monthly dividend income growth. It makes it one of the best dividend stocks in Canada today.