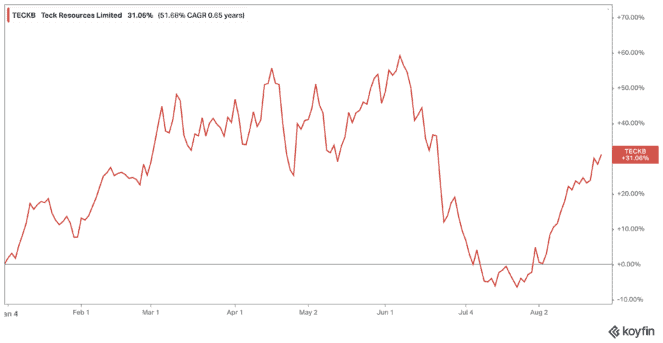

Teck Resources (TSX:TECK.B)(NYSE:TECK) shares have returned 35% to shareholders over the last month alone. This has come along just as the TSX continues to rebound, though it’s slowed in the last few days. But that’s not the case for Teck stock.

Teck stock hasn’t been growing for just the last month, after all. Shares are up 34% year to date, falling only after rising by 60% back in June. After that 41% fall from peak to trough, shares have started climbing once more and are now up by 40% since July 14.

One question: why?

Is it the industry?

Teck stock is a commodity stock, providing investors with access to a variety of resources around the world. This includes coal-making steel, silver, gold, copper, and even industrial chemicals. All of these resources provide the company with income that isn’t going to disappear overnight. But together, it creates a portfolio that is the envy of any commodity company.

Still, it’s not the only company out there in the commodity industry. Far from it. And one could argue that energy stocks have been a much better performer in a lot of ways. Some oil and gas stocks have more than doubled in the last few months, as oil and gas prices shift higher.

So, could there be another reason Teck stock continues to climb?

Is it the earnings?

It could be thanks to the earnings that Teck stock continues to produce. In fact, the company recently announced record earnings before interest, taxes, depreciation and amortization (EBITDA) of $3.3 billion for the fourth quarter in a row. This allowed Teck stock to both increase share buybacks and pay down debt.

Profit hit a new record as well for the quarter at $1.8 billion. But profit from shareholders also hit a record at $1.7 billion in the second quarter. Meanwhile, this is all while costs increased by 14% for the company under inflation. Yet despite record growth, both in profit and share price, analysts believe Teck stock is just getting started.

Is it the value?

Analysts point to the company’s value as the reason to buy Teck stock, even with shares growing so rapidly. The company has created strong cash flow and remains in a position to increase, even if its mining products decrease in value.

Meanwhile, Teck stock trades at an incredibly valuable price, with shares trading at just 4.62 times earnings. It offers a 1.07% dividend and even more growth beyond this year. Shares are up 1,120% in the last two decades, a compound annual growth rate (CAGR) of 13.3% as of writing. And it remains in an enviable position, with total debt covered by 34.9% of its equity.

Bottom line

I think you probably can guess where I’m going with this. Teck stock is a great opportunity because of all these reasons. The company has been growing immensely, creating new opportunities and generating record-setting profit for investors. Yet even as shares soar higher, it remains incredibly valuable. So, if it isn’t on your watchlist yet, I would certainly consider adding Teck stock right now.