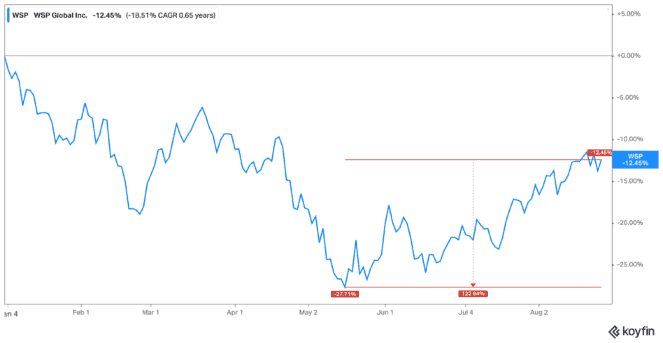

WSP Global (TSX:WSP) shares have climbed higher over the last few months, quietly creating returns for its shareholders. As of writing, shares are up 19% in the last three months and 13% in the last month alone. So, why are Canadian investors still ignoring WSP stock while it’s still down by 12% year to date?

What’s going on?

WSP stock is a consulting firm that helps governments, institutions, and private and public entities create infrastructure. This infrastructure spans the globe, hence the name. While infrastructure has always focused on a slew of projects from highways to railways, these days, there has been a shift.

Now, WSP stock has taken a focus on clean energy infrastructure. What’s more, it’s on the war path to eye up takeover after takeover, as it aims to become the go-to company in terms of creating global infrastructure surrounding climate change.

Most recently, its takeovers included RPS Group PLC in Britain for $975 million in debt, and it’s now raising $800 million to purchase RPS instead of borrowing. And yes, the company is in this buying frenzy, even as inflation and interest rates rise — something that could sting in the short term but create long-term growth for decades.

Investor activity not there

So, shares are climbing lately for WSP stock, which may make investors think they’ve missed out. Not so. WSP stock currently has an average trading volume of 157,776, which is fairly low on its own. But most recently, its volume was at just 72,539. That’s less than half the average trading volume, showing that investor interest lies elsewhere.

This means there is a real opportunity for investors seeking growth in the years to come — especially as it shifts to clean energy, as WSP stock continues eying up opportunities, and even as it becomes Canada’s largest engineering design firm, surpassing SNC-Lavalin last year.

Seeking future growth instead of short-term gains

Whereas other companies continue to seek the near-term opportunities of oil and gas infrastructure, it’s clear that WSP stock is seeking a more substantial approach. The recent takeover is the third major one in the last three months alone, with shares climbing higher at the news. Meanwhile, the company expects and increase between 15% and 20% in adjusted earnings per share through these takeovers as well as smaller ones.

The hope of this approach isn’t just to create opportunities for itself through these growing businesses but also to attract younger investors — investors that are more aware of climate change and want their businesses to do good rather than just create cold cash.

Still, cold cash is nice, and WSP stock has plenty of it. So, even while it trades at 42 times earnings, it’s still a strong choice for long-term investors to consider.

Bottom line

WSP stock continues to climb after bottoming out in mid-May. Since then, shares have climbed in the double digits, but analysts believe this stock is headed for so much more. With a focus on clean energy infrastructure as well as its ongoing contracts, WSP stock looks like it could be a major winner for investors willing to buy today and hold for years to come.