There are several different types of stocks investors can choose from in this environment. Many may elect to buy defensive stocks in order to add more resiliency to their portfolios. However, for long-term investors looking to take advantage of the current environment, growth stocks that have sold off significantly are certainly some of the best to buy now.

When companies can grow their operations consistently for several years, it often means they have a product or service that resonates well with consumers.

And the longer and faster these stocks grow, the more evident it becomes that they are some of the most dominant companies in their industry or have found a new niche that’s been untapped in a certain sector.

In addition, it’s important to note that companies often don’t grow rapidly and consistently for years without a top-notch management team.

On that note, these three growth stocks, which have impressive track records and a long run of growth potential ahead of them, are easily some of the best stocks to buy now.

One of the top growing real estate stocks to buy now

If you’re looking to add a high-quality growth stock to your portfolio today, InterRent REIT (TSX:IIP.UN) is one of the first to consider.

Not only does InterRent have a long track record of growth, but the REIT is also specifically intended to grow investors’ capital at a rapid pace.

To achieve this, InterRent is constantly looking at the best ways to use its capital. Sometimes that will include buying more properties to add to its portfolio, particularly assets that are considered undervalued or ones that have a tonne of organic growth potential.

Other times it will use its capital to renovate and upgrade its existing properties. This allows the REIT to increase the value of its properties and, therefore, the net asset value of the trust for investors. This strategy also allows InterRent to rapidly increase the rental rates it’s charging, which is why its revenue and income are constantly increasing.

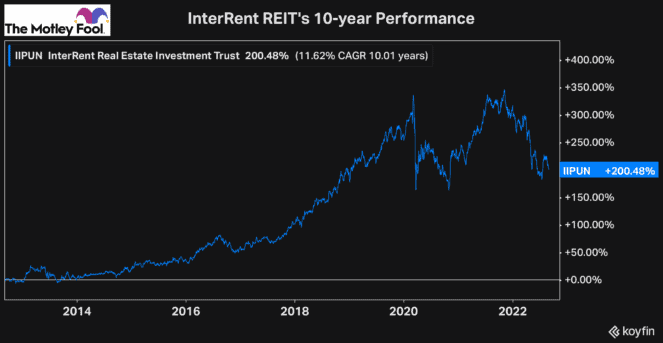

Over the last 10 years, InterRent’s revenue and funds from operations have grown at a compound annual growth rate (CAGR) of 17% and 32%, respectively. In addition, investors have earned a total return over that period of more than 200%, or a CAGR of 11.6%, even after the significant selloff this year.

Therefore, while InterRent trades well off its highs, it’s one of the top growth stocks on earth to buy now.

A rapidly growing financial stock

Another one of the top growth stocks in the world for Canadian investors to buy now is goeasy (TSX:GSY), a specialty finance company that provides many different types of loans to consumers across Canada.

The company typically loans to borrowers with below prime credit ratings, which inherently makes the stock a bit riskier. However, thanks in large part to the company’s strategic execution and consistently low charge-off rates, goeasy’s business economics have been just as impressive as the company’s incredible growth.

In the five years from the end of 2016 to the end of 2021, goeasy’s revenue and operating income grew at CAGRs of 15.7% and 35.8%, respectively. So it’s not surprising that over that period, the stock gained more than 370%, a CAGR of more than 36%.

Therefore, with the stock trading undervalued and nearly 50% off its high today, it’s one of the top growth stocks to consider.

A top retail stock for growth investors

The vertically integrated women’s fashion retailer Aritzia (TSX:ATZ) is another impressive growth stock to consider today.

While many retail stocks across the globe have struggled as e-commerce gains popularity, Aritzia has used that to its advantage while continuing to rapidly grow its physical store count.

And with the majority of its stores still located in Canada, it has an exceptional runway for growth south of the border. Plus, the stock has an impressive track record, showing just how fast it can expand its operations.

Over its last five fiscal years (including through the pandemic), Aritzia’s revenue and cash from operations have grown at CAGRs of 17.5% and 24.7%, respectively.

Therefore, while this high-potential growth stock has pulled back from its highs, it’s one of the best investments Canadians can make today.