If you are a beginner investor and you want to create life-changing wealth, the Tax-Free Savings Account (TFSA) is a tool you need to use.

If you invest in a non-registered account, the Canada Revenue Agency takes a greedy portion of any investment profit or income you earn. Over a long period of time, it can drastically reduce your long-term returns.

The TFSA is a wealth-compounding machine

That is why the TFSA is an absolute gift to Canadians. If you were 18 years or older in 2009, you can contribute as much as $81,500 today.

By keeping all your earnings, you can re-invest even faster and drastically accelerate the snowballing effects of compounding. Likewise, by regularly contributing to your TFSA, you can quickly expand the base from which your wealth can compound. All in all, it is a recipe for long-term wealth creation.

Even if you don’t have $81,500 today, you can turn $20,000 into generational wealth. Here are two well-known Canadian stocks that could help you get there.

TD Bank

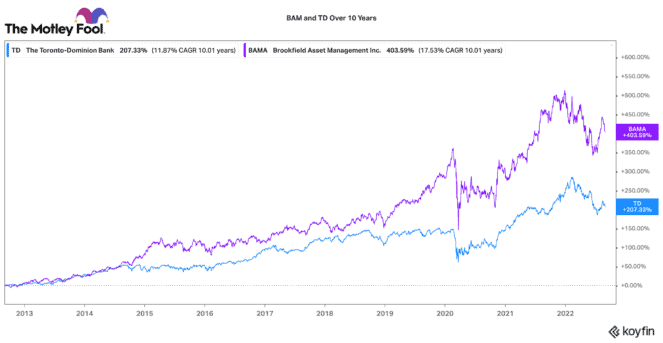

While Toronto-Dominion Bank (TSX:TD)(NYSE:TD) is not perhaps the flashiest TSX stock for a TFSA. However, it has delivered market-beating returns for years. Since 2012, shareholders have earned an average annual return of 10.76% (versus 5.3% for the TSX). If you re-invested your dividends into TD stock, your annual return would increase to 12.19%.

TD stock continues to be a solid investment going forward. It has a strong retail platform across Canada and the United States. It has recently made further inroads into the U.S. market through two substantial multi-billion-dollar acquisitions.

Given its size, scale, and quality, TD stock is a safe bet for most Canadian investors. Chances are good that it will outperform the market and earn an attractive, growing +4% dividend yield going forward.

Brookfield Asset Management

If you are interested in a very solid company with a little more torque for growth, Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM) is a good TFSA staple. It manages a diverse array of alternative assets including real estate, infrastructure, renewable power, private equity, distressed debt, and insurance. Owning this stock is like owning a diversified portfolio in and of itself.

Brookfield stock has averaged 16.3% annual returns over the past 10 years. If you re-invested its modest dividends into its stock, you would have earned 17.06% compounded annual return. That does not factor several spin-off companies that Brookfield has also gifted to shareholders in that time.

Overall, Brookfield is a very well-managed business with a huge long-term opportunity to keep growing its asset base and earnings. The stock has pulled back in 2022, and it looks like an attractive bargain for long-term TFSA shareholders.

How a $20,000 TFSA becomes $540,000

Let’s say you put $10,000 into TD stock and $10,000 into BAM stock. Since they are in a TFSA, any dividend or potential spin-out is safe from tax. That means you can re-invest all income back into each stock.

If we assume a combined average annual rate of return of 14.63%, a $20,000 initial investment could be worth $300,000 in 20 years!

However, if you wanted to accelerate the compounding process, you could commit to contribute $200 every month to your TFSA. If you regularly buy these two stocks with the contributions, your investment value could skyrocket to $540,000 in 20 years!

The bottom line

This is merely one simple example of how the combination of regular saving, smart stock picking, tax-free returns, and long-term investing can massively multiply your TFSA capital into life-changing wealth. You just need to start. The sooner you begin, the better.