Albert Einstein once described compound interest as “the eighth wonder of the world.” Patient investors who buy high-quality stocks, reinvest dividends, and hold for the long term are capable of turning even modest amounts into comfortable retirement nest eggs.

Still, for investors starting out with less money (think $1,000ish), investing can be daunting. Imagine trying to buy a share of Amazon pre-split when the stock traded at over US$2,000 per share! You’d barely be able to afford half a share, let alone diversify with other stocks.

This can be discouraging, but fear not! There is a solution if you’re strapped for cash. With this alternative, even the smallest of investment portfolios can grow strongly.

ETFs are the solution

Thanks to exchange-traded funds (ETFs), investors no longer need vast sums of money to buy dozens of individual stocks. ETFs trade with their own ticker on a stock exchange and can hold a basket of up to thousands of various stocks. Some ETFs are basically all-in-one stock portfolios that are managed on your behalf by a professional.

This approach is capital efficient. For instance, an ETF might trade at a price of $50 per share yet hold over 1,000 stocks in it. With your $1,000, you can now buy 20 shares of that ETF and gain proportional exposure to all of its underlying companies. This way, you become diversified without needing to buy 1,000 individual stocks!

Index ETFs are ideal

ETFs aren’t a free lunch though. They charge a management expense ratio (MER). This is a percentage fee deducted from your investment on an annual basis. For example, an ETF that charges a 0.05% MER would cost an annual fee of 0.05 * $1,000 = $5 on your $1,000 investment.

Keeping this as low as possible is ideal, and the best choice to make for a low MER is an index fund. These are passively managed investments that track an existing stock market index, like the S&P 500. With index funds, fees are low since the fund manager isn’t actively trying to pick stocks, so fund turnover remains minimum.

I like the CRSP U.S. Total Market Index. This index tracks over 3,500 stocks listed on U.S. exchanges, from all 11 stock market sectors, and covers large-, mid-, and small-cap stocks. In many ways, it is the ultimate hands-off investment. Buying this index allows investors to match the long-term performance of the U.S. stock market.

Why the U.S. stock market

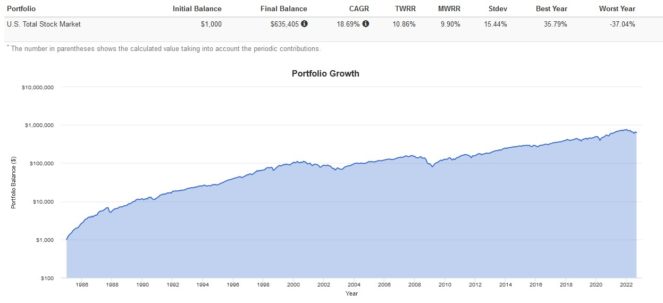

Since its inception in 1971 to date, the U.S. stock market has returned a compound average growth rate (CAGR) of around 13.3% with dividends reinvested. This is a fantastic return that could turn your initial $1,000 deposit into high six-figures over several decades even with only modest contributions. Let’s use a real-life example to see this in action.

Imagine you started investing in 1985 as a broke 18-year-old student with just $1,000 to your name. You invest it all in an index fund tracking the U.S. stock market. Every month thereafter, you scrounge up $100 and invest it promptly in a disciplined and consistent manner.

After holding the ETF for 37 years, consistently putting in $100 every month, reinvesting all dividends, and never panic selling, you would be able to retire early at 55 with a cool $635,405.

This is incredible considering that all your hypothetical self did was buy an index fund, consistently invest small amounts, and stay the course. If you started with more than $1,000, held longer, or contributed more than $100 monthly, your returns would have been even better. With this strategy, maximizing your contribution rate and staying invested is key.

Do you want to implement this passive, hands-off investing strategy? A great ETF to use is Vanguard Total U.S. Stock Market Index ETF (TSX:VUN), which has a low MER of just 0.16%. VUN trades at around $70 per share right now, making it accessible to investors with a smaller portfolio.