A tech stock that made investors rich in 2021 has dipped below its initial public offering (IPO) price. Lightspeed Commerce (TSX:LSPD)(NYSE:LSPD) stock started descending in September 2021 after it became the target of a short-seller. It went into a free fall when the tech stock bubble burst on December 31, 2021. The stock saw its bottom at $20 in May from its peak of $159 in mid-September 2021. Every recovery followed a correction. This time, the stock fell 25% September 2 and is now trading below $24 a share.

Why did Lightspeed stock fall? How long will the see-saw price movement continue? How can you make money from Lightspeed stock’s current situation? In this article, I will address all three questions.

Why did Lightspeed stock fall?

Lightspeed Commerce is an e-commerce company that earns money when transactions happen on its omnichannel platform. The volume of transactions is directly proportional to revenue. However, its profit depends on higher average revenue per user (ARPU). Rising inflation and interest rates are pressuring consumer demand and retail commerce.

As Lightspeed stock inflated to unprecedented levels in the tech stock bubble, many investors lost more than 80% of their value. It is common for investors to trade with caution when faced with huge losses and a tight money supply.

Hence, news around rising interest rates or inflation pulls the stock down. And that is what happened with Lightspeed in August. Investor sentiment was already shaken after Lightspeed’s net loss doubled to US$100.8 million in the fiscal 2023 first-quarter earnings report on August 4. But tension has started growing around the September interest rate.

On August 26, the U.S. Fed chair made it clear that Fed will continue to increase interest rates and keep them high for longer than investors expected (mid-2023). This speech took away the 36% recovery in Lightspeed stock towards July’s end, when U.S. inflation eased slightly to 8.5% from 9.1% in June. Hence, a combination of ballooning losses and rising interest rates pulled the stock down 25% in 30 days.

How long will the see-saw price movement continue?

Lightspeed is seeing a recovery in business activity, as people return to in-store shopping and dining. It has paused its growth through acquisitions, which it funded through equity capital and stocks. With its stock losing 80% value, it is focusing on the already acquired companies to boost organic growth. The company has to increase its share value to use it for future acquisitions.

As a growth stock, it is trading at 4.3 times its sales per share, which is an attractive valuation for a 35-40% revenue growth rate. But its widening losses are making investors apprehensive in a recessionary environment. The company’s US$915 million cash reserve, which gives it the financial flexibility to withstand losses, is keeping shareholders invested.

Lightspeed stock could continue to see price volatility until mid-2023, hoping the Fed interest rate hike slows and the economy shows signs of recovery from a recession. This could take more than a year. But for now, it is comfortable to say that Lightspeed’s see-saw stock price movements could continue to mid-2023 until the economic recovery begins.

You can make the most of these 10-12 months through active trading. But be warned that there is risk, as the stock could make a new low if the recession deepens.

How to make money from Lightspeed stock’s current situation

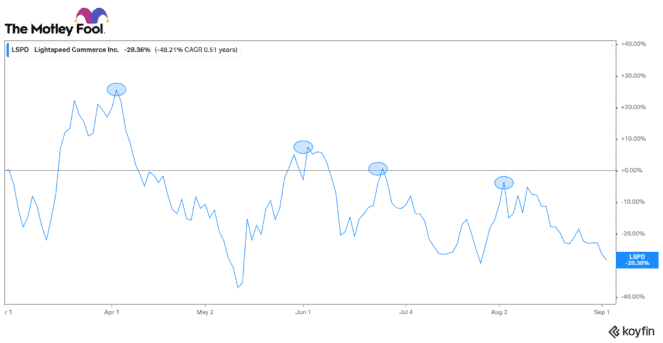

Since April, Lightspeed stock has witnessed three peaks and troughs. Every peak is lower than the previous one, hinting that the recovery rally after every dip is fading (70%, 27%, and 36%, respectively). Seasonality is one of the factors for this weakness.

Lightspeed stock is trading in the $23-$30 range, representing a 30% upside and downside. You can buy the stock near $24 and sell it as it approaches $29, booking a 21% return.

I expect the peaks to grow to $34 in the second half, as this holiday season, Canadians and Americans celebrate after two years of covid restrictions. If you purchase 100 shares of Lightspeed, you can put a sell trade for 70 shares at $29 and 30 at $33. Instead of quick returns, you could also buy and hold the stock and wait for growth to return in an economic recovery.