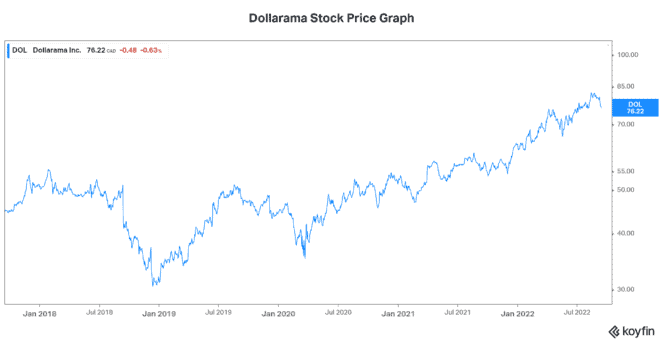

After many years of outsized returns, growth stocks have fallen far out of favour in 2022. There’s plenty of good reasons for this. Rising inflation, interest rates, and the risk of a recession are a few. Yet, it’s hard to let them go. Thankfully, the truth is that we don’t have to. We just have to focus on the right kind of growth stocks. They include stocks like Dollarama Inc. (TSX:DOL) and Waste Connections Inc. (TSX:WCN)(NYSE:WCN).

Read on for more on how Dollarama and Waste Connections are growing and driving shareholder value, even in this challenging market hit by inflation.

Dollarama stock: One the most resilient growth stocks to buy

Dollarama is one of Canada’s best success stories. From its start with one store in 1992, to more than 1,400 stores today, its growth has been historic. With its clear and focused business model, Dollarama has survived many crises for one simple reason – it offers the most compelling value for its customers. Dollarama is the last one to raise prices and the first one to raise the bar on its value proposition.

The macro environment today presents many challenges for retailers. For example, inflation is eating away at shoppers’ wallets. It’s also increasing costs for all businesses. The expected result of these pressures is lower revenue and lower margins. Dollarama, however, is not your ordinary growth stock.

Selling more discount goods at higher prices

In its latest quarter, Dollarama reported rising sales and a gross margin that was essentially flat relative to last year. These are both respectable results given the environment. Same store sales increased 13.2%, as the number of transactions increased 20%. Clearly, shoppers are flocking to the value proposition that Dollarama offers in these difficult times.

Moving further down the income statement, we can see that EBITDA increased 25.8% and EPS 37.5%. Dollarama has maintained its growth stock status in these difficult times in three different ways. First, the company introduced the $5 price point. This came after gradually scaling up its highest price point. It was necessary, as costs were rising. Secondly, Dollarama has continued to open new stores. In its latest quarter, 13 new stores were opened. Also, the company is on track to meet its annual target of 60 to 70 new stores this year.

Dollarama has continued to expand in order to bring its value proposition to new markets. The earnings growth that Dollarama is enjoying from its DollarCity investment has been phenomenal. Dollarama’s 50% share of DollarCity’s net earnings increased 87% over the year-ago quarter.

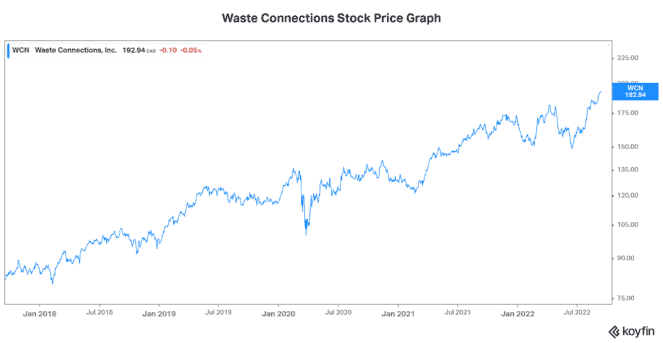

Waste Connections: Increasing its dividend and outlook

Another growth stock that’s a buy today is Waste Connections. Strong revenue growth is what most typically characterizes growth stocks. This often comes with negative earnings and cash burn. With Waste Connections, we get soaring revenue as well as free cash flow, and dividends. In my opinion, this is always the best kind of growth stock. In today’s environment, this is especially true.

Waste Connections is an integrated solid waste services company. It provides waste collection, disposal and recycling services in the U.S. and Canada. The waste services market is highly fragmented. Waste Connections has been consolidating it, and acquisitions are an integral part of its growth story. Last quarter’s revenue increased 18.4%. Organic growth accounted for 9% of growth, with acquisitions accounting for the rest.

It’s a growth stock, but it’s also a defensive stock due to the nature of its business. While Waste Connections has also felt the sting of rising costs, this company has pricing power. In fact, in its latest quarter, its pricing increased 8.8%. This allowed the company to offset the cost of inflation it’s experiencing.

Waste Connections stock is up 18% in the last year alone. The five-year return is 124% and 10-year return a rocking 583%. All this growth is backed by growing cash flows flowing into dividends, and building shareholder value. As long as Waste Connections continues to create value, WCN will be one of the best growth stocks to buy today.