Are you looking for a top growth stock? Join the club — a massive club with too many members all vying for the same stocks. However, there are some companies that continue to be ignored, even if they corner a huge market.

For example? Pet Valu

Pet Valu Holdings (TSX:PET) is one example. Pet Valu stock corners a huge market, which is obviously the pet market. And as inflation and interest rates rise, making pet products more expensive, Pet Valu stock has become a great way to battle back the prices.

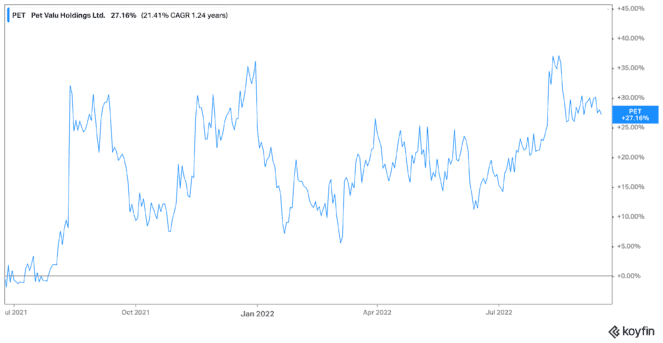

The main issue is that Pet Valu stock didn’t come on the market at a great time. The company had its initial public offering (IPO) just last year. Since then, shares have grown by 27%, which is certainly not bad.

During the year, it hasn’t been terrible either. Year to date, shares of Pet Valu stock are down by 6.6%. In the last three months, they’ve grown by 11%. That’s after coming down from a huge jump due to earnings.

What earnings told us

Pet Valu stock posted amazing earnings back in August. Same-store sales rose by 21.2%, as there was a rise in transactions with more customers buying more things. This caused the company to increase its full-year sales outlook to between $912 and $928 million for 2022.

Net income for the second quarter came in at $25.3 million, which was almost half of last year. Still, revenue rose 25% to $227.7 million as well. It looks like these numbers are set to keep rising as the pet store launches another 35-45 new store openings for the year.

Meanwhile, despite being a new stock, Pet Valu stock offers a dividend yield for its shareholders. That’s not huge, but still, a 0.72% dividend yield is better than no dividend at all.

A growth stock to consider

What’s great about Pet Valu stock is it’s still so new. Sure, this could be seen as a negative. But if you’re looking for a growth stock, it’s great to come in near or at the ground floor. That’s what you get here.

Further, Pet Valu stock has pretty much cornered the Canadian market in terms of pet stocks. If you want access to the increase in pet products during the pandemic, this is the way to do it. The company is at fair value right now, trading at 24.28 times earnings, so I wouldn’t call it cheap or undervalued. But looking long term, I would consider it a great deal. It has a solid handle on debt, offers a nice dividend, and has potential for stellar growth out of this market correction.

Bottom line

If investors can find a growth stock that offers stable income, they should grab it in spades. Even if it’s new. Pet Valu stock is an example of a company that can corner a huge market in Canada. Pets are a part of our lives, even if you don’t have one. So, if there’s a way to make cash on this industry, I suggest you take it. And Pet Valu stock is pretty much the only option out there.