I have to say, I really feel for young investors these days. I’d still consider myself one, as I’m only in my thirties, but it’s even harder for those who are opening a Tax-Free Savings Account (TFSA) for the first time.

Young investors today are going through some pretty intense life moments. I can relate, because as a millennial, I experienced similar challenges. If you’re a young investor who’s just starting out, here’s how you can enter the markets while still paying the rent.

Budget!

I know, this is likely something your parents told you before you left the house. But wow it’s true, and wow people simply ignore it. Instead of just blindly sticking to some random monthly goal, come up with a budget that makes sense for you.

If you cannot live without a Tim Horton’s coffee every morning, throw it in the budget. If you don’t want to miss out on socializing with friends on the weekend, in it goes. But if you’re spending tons of money on new clothes at higher-end stores, take a pause. Same goes for eating out at expensive restaurants. Take some time to consider what must stay and what can go, and this will help you immensely.

Once you’ve created a budget that makes sense, build in rewards! A reward system can be an excellent motivator for any type of goal, from finance to weight loss. One of my favourite rewards is to book a massage after I’ve accomplished a goal, because it’s usually entirely covered by my health care provider.

What’s left?

Now that you’ve created a budget based on what’s coming in and what’s going out, it’s time to identify what’s left. When you’re older and making more consistent cash, that’s when I would recommend putting aside 5% to 10% of each pay cheque towards investing. But you may not have that right now.

That’s fine, don’t stress! Anything is better than nothing, even if it’s $5 each month. Sure, it isn’t much, but you could grow this amount in the future. What’s key is keeping it consistent. Plan automatic contributions so you don’t even have to think about it. Then you can watch your small investment blossom over time and feel a sense of pride.

And again, reward yourself! This can be hard, especially during a period of inflation when you’re not bringing in much, but try to find a way to celebrate every single win.

Invest!

Now is the fun part. Whether it’s consistently throughout the year, on an annual basis, or if you have alerts on a watchlist, invest in your chosen stocks. If you’re a young investor, the best thing you can do is pick long-term holds that will grow higher and higher over time. These include blue-chip companies offering dividends.

Blue-chip companies are those that have been around for decades and will be around for decades more. How do we know? Because they’re in sectors that aren’t going anywhere. There are plenty to choose from, but if you want a cheap entry point with dividends, I’d consider Brookfield Renewable Partners LP (TSX:BEP.UN)(NYSE:BEP).

Brookfield stock is backed by Brookfield Asset Management and has over 100 years of growth behind it! It’s in the renewable energy sector, buying up energy assets around the globe as the world shifts to clean energy.

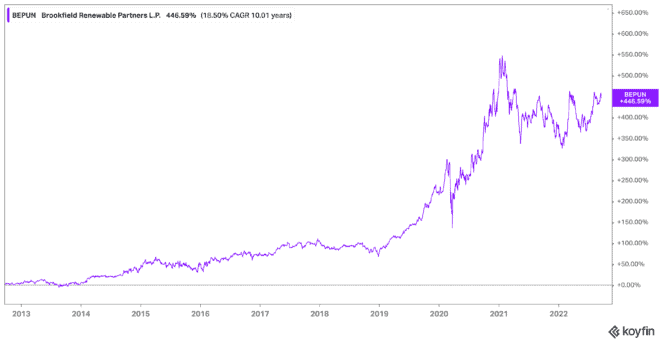

The stock is already up significantly, and young investors can look forward to this company growing even more. Shares have skyrocketed by 449% in the last decade, and it offers a healthy 3.33% dividend yield as of this writing. Yet it’s also safe, with enough equity to cover its total debts.

Bottom line

If you were to put $10 away each year for the next decade, you could invest in Brookfield stock maybe twice a year for now. That’s what $120 would get you, so you wouldn’t be accumulating much wealth from dividends at just $3.36 per year.

But it all adds up. Let’s say young investors continue to put $10 away each month for a decade. By then, you would be making $50.54 in dividends, with a portfolio worth $3,750.50. Keep doing that for a total of 30 years, and you could have a portfolio worth $133,389 and collect $292 in dividends! All from just $120 per year, and $10 per month. So, there’s no harm in starting small, and there’s much to gain from starting early.