This summer was a volatile one for investors. Inflation and interest rates continued to climb higher, and this led to a drop in the markets. Still, that doesn’t mean every stock was falling.

In the past three months, there have been a few standouts that I’m going to cover today. As well, we’re going to look at these industries to see if we can get some takeaways that could help investors seek out new growth stocks in the future.

Uranium

The uranium market could possibly be one of the most volatile growth stocks of the last few years. Stocks swung around back and forth, and it made it really difficult to figure out what would stay and what would go.

While smaller uranium stocks tended to swing wildly thanks to retail investors, Cameco (TSX:CCO)(NYSE:CCJ) remains a solid investment. Uranium will be necessary in the immediate future with the world shifting from oil and gas to renewable energy. And that’s why Cameco stock is such a good play.

The uranium provider is one of the largest in the world, creating partnerships across the globe to help with the energy transition. True, it’s expensive, but shares are likely to climb even higher in the next decade with this shift.

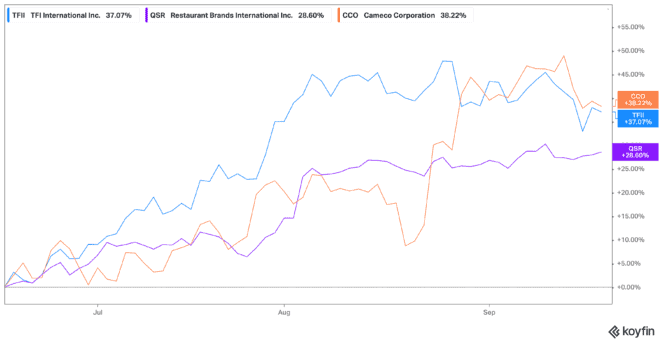

Shares of Cameco stock are up 35% in the last three months.

Transport

All these issues with supply chain logistics begs for solutions. Even as I’m writing this article, it’s been weeks since I’ve been able to buy sugar and ibuprofen for my kids. While part of this is due to inflation, the other is simply getting products into stores.

That’s why TFI International (TSX:TFII)(NYSE:TFII) has been a solid performer this summer. It provides solutions both through logistics but also through plain, old shipping with their transportation and packaging arms. Yet in this case, TFI stock is a solid value play, trading at just 15.13 times earnings.

Furthermore, TFI stock offers a dividend of 1.13% for investors. Right now, it’s up 33% in the last three months.

Restaurants

The pandemic restrictions have lessened to practically nothing, so consumers are back to shopping in store and eating out once more. This is likely why shares of Restaurant Brands (TSX:QSR)(NYSE:QSR) have climbed higher.

But I wouldn’t be so fast to buy up this stock in bulk. There has been some shifting performance from Restaurant Brands stock that has me questioning whether it’s a solid buy at this moment in time. Its Tim Hortons branch has been doing well through its partnership with Justin Bieber and new offerings, but not its other brand names.

And while its dividend is reasonably high, it’s not exactly cheap. I would perhaps hold off on Restaurant Brands stock, unless you plan on holding it for quite some time.

Shares of Restaurant Brands stock are up 26% in the last three months.

Bottom line

These growth stocks have seen an insane amount of double-digit growth in a very short period of time. However, while some are up higher than ever, some remain far below former price points. So, make sure you’re not just buying these growth stocks because they’re up but because they’re in sectors that are set to continue expanding.