It might surprise you to learn that some of the best investments Canadians can make when looking at U.S. stocks is in the tech sector. While Canada certainly has a few winners of its own, there is a benefit to finding these U.S. stocks.

The biggest benefit is that you can buy the biggest and the best — ones that have been around for decades, are household names, and simply aren’t going anywhere. Today, I’m going to look at the three no-brainer U.S. stocks every Canadian should consider.

Amazon

Amazon (NASDAQ:AMZN) is a huge no-brainer for Canadian investors to consider today. I likely don’t have to get into the history of Amazon stock or why it’s done so well. But I will definitely tell you about why you should consider it as one of your top U.S. stocks to buy.

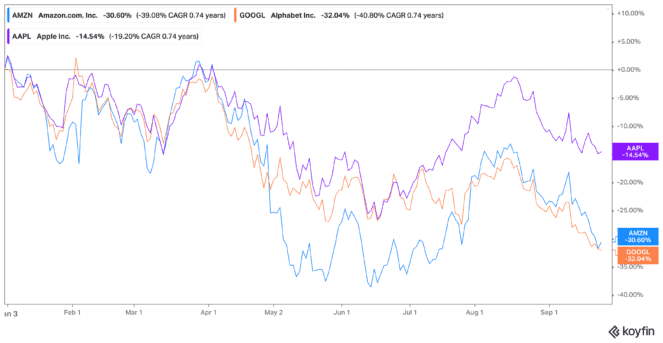

Amazon stock has become a household name, expanding far beyond its place as a bookseller. It’s now the e-commerce company to beat and still finding new ways to bring in more buyers. Yet because of this focus on e-commerce, shares of Amazon stock are down 31.5% year to date.

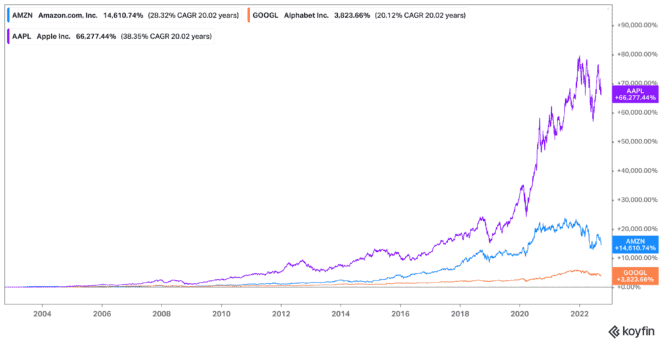

This provides a great way to get in on one of the best U.S. stocks out there. Shares have increased an insanely high 14,572% in the last two decades alone! That’s despite coming down from all-time highs. So, if you’re looking to see your shares recover, this is a great way to do it.

Alphabet

Another strong option is Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL). Alphabet stock is similar to Amazon stock in that it’s expanded far beyond where it started as a web search engine. It’s now the web search engine to beat, but it has also become the go-to for e-mail and cloud services for its storage options.

And again, Alphabet stock is simply not stopping when it comes to expanding its empire. It now offers phones, tablets, cybersecurity, anything really that has to do with tech. Yet what’s insane to me is that it’s almost in undervalued territory.

Alphabet stock trades at just 18.62 times earnings, with shares up 3,828% in the last two decades. Yet year to date, those shares are down by 32%. This provides a strong place to jump in to see more growth for decades.

Apple

The last no-brainer is Apple (NASDAQ:AAPL), of course. Apple stock is similar to Alphabet stock in that it focused in on an area of tech that simply needed to be filled. In this case, it was providing sleek tech products for the growing use of the internet.

Now, Apple stock is the one to beat when it comes to phones, tablet, computers, and more. It’s constantly upgrading its services, which has including keeping data safe for its 1.4 billion Apple users as of 2019.

Yet again, Apple stock is practically in value territory trading at just 25 times earnings. While its product launches have slowed down in the past few years, I wouldn’t count the company out. Analysts certainly aren’t, especially with shares exploding 66,361% in the last two decades! So, with Apple stock down 14.5% year to date, I would still consider it a no brainer buy among U.S. stocks.