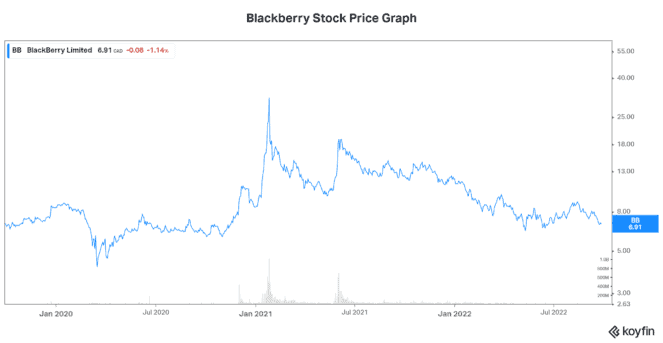

BlackBerry (TSX:BB)(NYSE:BB) stock has fallen more than 40% in 2022. It has been a wild ride, with equal parts volatility, stress, and excitement. Is this great Canadian tech stock done for? Or is this the best opportunity to buy it at multi-year lows? As part of a diversified Registered Retirement Savings Plan (RRSP) portfolio, I think that Blackberry can offer the kind of upside and torque we’re all looking for.

Let me explain.

BlackBerry stock falls victim to a difficult macro environment

Markets have been weak. In fact, the TSX has fallen 14% in 2022. This type of market is difficult on all stocks. But it’s mostly difficult on those that don’t have earnings or visibility — like BlackBerry.

But clearly, this isn’t the only factor that’s driving BB stock down on the TSX. Sentiment has understandably been very negative, as BlackBerry has been working on its transformation for many years now. Yet the transformation that it undertook was the right one. The cybersecurity and the embedded systems businesses are two of the most exciting and promising in the tech world today. The problem is that BlackBerry is still fighting its way to the top. It’s been a long road, but there are many reasons to be excited.

Quarterly results conference call gives encouraging tidbits

Clearly, we’re all on edge, wondering when the carnage will stop. Every RRSP has taken a hit. So, we’re understandably nervous to buy a stock like BlackBerry. But the company reported its quarterly results yesterday, and I came away encouraged. Most importantly, revenue of $168 million and earnings-per-share (EPS) of a loss of $0.05 came in slightly better than expectations. This implies that the expectations built into the stock are too low.

Also, Chief Executive Officer (CEO) John Chen discussed the business and BlackBerry’s advantages. Let’s start with QNX, which is BlackBerry’s operating system that’s been in cars for decades. It started as “infotainment” but has rapidly evolved into so much more. Today, BlackBerry’s operating system for automobiles is focused on safety and security. And this is where BlackBerry has a big advantage.

You see, BlackBerry’s QNX is the system that has the highest level of ISO safety certification. This is, in fact, BlackBerry’s “claim to fame.” According to the CEO, it’s been difficult for auto companies and competitors to replicate. This is why QNX is in over 200 million cars today. This is good, but it’s just the beginning.

IVY takes things to a new level

QNX is already the biggest player in the auto embedded-software space. And this has been driving new client wins. For example, BMW, Volvo, and Volkswagen are some of the high-profile wins that BlackBerry has had in recent quarters.

In late 2020, Amazon Web Services and BlackBerry announced a partnership to develop and market Blackberry’s Intelligent Vehicle Data Platform, IVY. Essentially, IVY is the data engine that powers any data-driven application that developers build for a car.

The progression of IVY is going as expected. This means that BlackBerry hopes to have it go into production by the end of the year. The IVY pilots have been successful, and the company is inundated with requests to test the software.

Clearly, the potential of BlackBerry’s embedded systems does not end with the auto industry. In fact, its already being used extensively in the medical industry as well as in industrial applications. This is a testament to the fact that Blackberry’s systems are of the highest quality. Looking even further ahead, BlackBerry is in the early stages of pursuing certification in the aerospace industry. This industry is a natural extension for BlackBerry’s systems.

Motley Fool: The bottom line

For what it’s worth, BlackBerry’s CEO has maintained his previous revenue projections — as things are heading the down the right path. For example, the Internet of Things (embedded systems) segment is seeing strong year-over-year revenue growth (+28%). Right now, this segment accounts for 30% of BlackBerry’s total revenue. Also, in cybersecurity, the pipeline is seeing momentum. These are the signs that the worse may be over. In fact, it BlackBerry stock just might be one the best stocks for any well-diversified RRSP portfolio.

Like Blackberry, an RRSP has a long-term timeframe.