Wouldn’t you love to own stocks that you can just hold forever? Do you want stocks that carry little worry or stress, because you just know that in the long run, they’re solid. Well, there are bargain stocks like these, we just have to find them. The key is to keep your eyes on the long run and to turn your ears away from the noise — do it the Motley Fool way.

Here are two of these stocks.

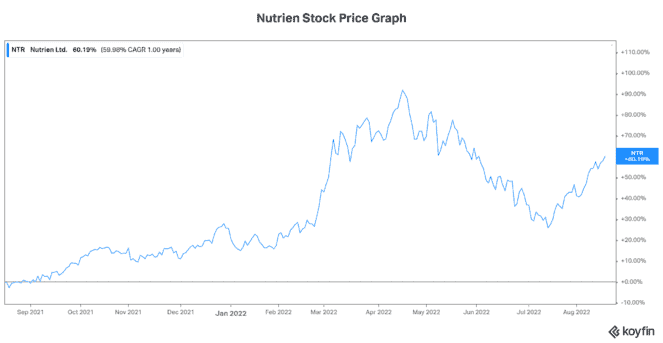

Nutrien: A bargain stock with huge earnings growth

Nutrien (TSX:NTR)(NYSE:NTR) was formed through the January 2018 merger between Potash Corp. and Agrium. It’s taken its place as the world’s largest provider of crop inputs and services. For example, Nutrien supplies potash, which is a fertilizer that helps increase crop yields and resist disease. It’s just one of a handful of products that Nutrien’s global supply chain provides to help “feed the world.”

In the long run, Nutrien has a very powerful driving force — an increasing global population. This means that we can reasonably expect that Nutrien will see steady and growing demand for its agriculture products and services.

The current positive demand/supply fundamentals are reflected in Nutrien’s 2022 results. In the first half of 2022, Nutrien posted record earnings and cash flows — up 300% and 38%, respectively. This has been a function of higher prices, the company’s strong operational performance, and its unmatched global footprint.

But why is Nutrien stock so cheap? Trading at a price-to-earnings ratio of seven times and a price-to-book ratio of 1.7 times, there seems a clear disconnect. I mean, Nutrien is generating massive earnings growth. And this momentum and strength is expected to continue. Also, the company is generating a return on equity of 27% — it has no business being so cheap.

Maybe it’s the cyclicality of the business that’s the root cause of the undervaluation of Nutrien stock. Admittedly, there have been some rough years. Or maybe it’s just not that exciting of a business compared to the other choices that we investors have. Either way, I don’t expect this bargain to last much longer, but I do expect that the business will continue to thrive in the long run.

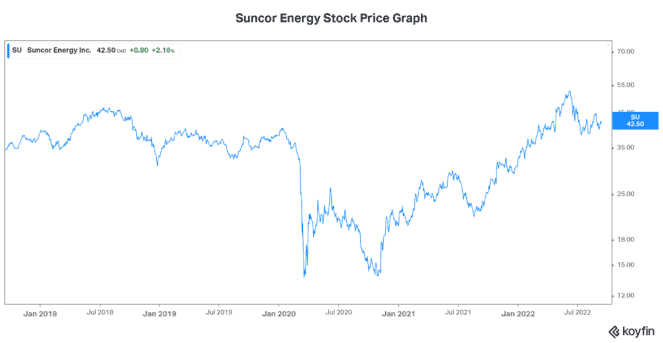

Suncor Energy: Investing in its future

Suncor Energy (TSX:SU)(NYSE:SU) is Canada’s leading integrated oil and gas companies who is currently posting record cash flows amid high oil and gas prices. But it’s trading at a mere six times earnings and 3.3 times cash flow. What’s the deal? Is Suncor Energy stock dead in the water, or is it one of the best bargain stocks on the TSX today?

I think it’s the latter — it’s one of the best bargains. This is because Suncor is awash in cash flow. In fact, in Suncor’s most recent quarter it posted $5.3 billion in operating cash flow. This has resulted in major debt reductions and dividend increases. The dividend was increased 12% this year, and Suncor has an 8% five-year compound annual dividend growth rate (CAGR).

But the big issue here is the longer-term question: what will happen to Suncor given the global energy transition? Well, Suncor has accepted this transition. Given this, Suncor has been attempting to find its place in this new world.

Actually, Suncor has been investing in renewable energy for many years — as early as the early 2000s. This is a work-in-progress and there’s a big learning curve. New solutions are being explored and discovered. As an energy giant, Suncor knows that it must invest in renewables today to secure its place for tomorrow. However, earlier this year, Suncor announced a strategic shift. It’s divesting its wind and solar assets to pursue the less expensive hydrogen and renewable fuel opportunities, which are huge. These renewable energy sources align more closely with Suncor’s expertise and assets.

So, this is the roadmap for long-term growth and viability. Suncor Energy stock is dirt cheap right now, and it’s investing in the future while profiting hugely from strong oil and gas fundamentals today.