In the land of defensive stocks, Fortis (TSX:FTS) stock is second to none. There are many reasons for this. Firstly, it’s a regulated utility. Also, its business is highly insensitive to the economic environment. Lastly, Fortis stock has the size and the track record that translate into reliability and predictability — all good things, especially in today’s volatile environment.

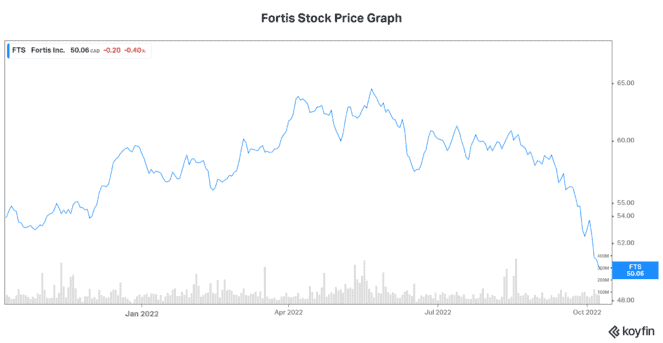

Fortis stock has been hit hard in 2022, despite Fortis’s many strengths. You see, that’s just the way it is. When investors get spooked, the market gets hit, and it takes everything down with it.

Let’s step back and review if now is the time that you should invest in this most solid and reliable stock.

Fortis stock sinks 17% in 2022

Currently trading at just over $50, Fortis’s stock price has seen better days. However, I would argue that even Fortis was swept up in the overly optimistic attitude that dominated in recent years. So, it’s coming off levels that were too optimistically high. I mean, low interest rates were meant to boost the fortunes of all. And they did just that. But did we really think they would last forever?

It makes perfect sense that rising interest rates will have the opposite effect on all stocks. First, there’s the obvious: rising interest rates increase the cost of borrowing, hitting earnings. Also, rising interest rates reduce the present value of future cash flow and earnings. All stock prices are the present value of expected future earnings and cash flows. Higher interest rates mean future cash inflows have a lower present value. And this hits stock prices directly.

If we accept these basic facts, we can move on to consider what to do in this environment. Let’s consider whether Fortis, which saw its stock price fall 17% (versus the TSX, which fell 14%), is a good buy now.

A very generous dividend yield

Fortis stock has really come down hard. The very resiliency and predictability of utility stocks like Fortis usually means that they should outperform the market in a downturn. But this has not been the case in 2022. What this has done is created an outsized opportunity in my view.

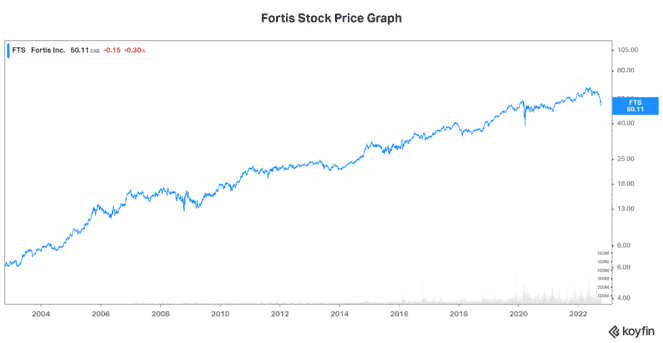

Fortis’s dividend yield is currently a very attractive 4.5%. Not only is it generous, but it’s really a pretty low-risk deal. This dividend has virtually no risk of being cut. It’s highly reliable for a few reasons. For example, Fortis is a regulated utility. This means that its returns are guaranteed. Also, the company’s revenues are sheltered from the economic storm that we’re in. Finally, Fortis has the ideal track record that speaks for itself — dividend increases for 49 consecutive years and steady, consistent long-term capital appreciation.

Rising rates and inflation

I want to circle back to the issue of rising rates for a minute. An added pressure point for Fortis is the fact that as a utility, it’s pretty heavily indebted. This is the nature of this business, which is highly capital intensive. In fact, Fortis’s debt-to-market capitalization ratio is a high 55%.

While this is certainly a strike against Fortis, the company is successfully managing this risk. For instance, $1.5 billion of debt was raised this year, but it was done early in the year in order to secure lower rates. Also, Fortis is using derivatives to hedge this risk. Lastly, the company is looking for ways to reduce costs for all, through energy efficiency and cost efficiency programs.

In conclusion, Fortis stock has recently become very attractively valued. This has uncovered a strong buy opportunity for this high-quality, 4.5%-yielding stock.