The stock market might not be in crash territory, but it has certainly moved beyond correction territory. Year-to-date, the CRSP U.S. Total Market Index has fallen more than -25%, marking another descent into bear market territory. As the U.S. Fed continues to aggressively hike interest rates, more volatility is likely ahead.

Many new investors are probably worried about whether or not it is “safe” to invest. It’s a terrible feeling to sink $10,000 into stocks and immediately see the market fall again the next day. Whether in the form of a slow bleed or a sharp sell-off, nobody likes to lose money.

Still, bear markets are money-making opportunities. During these times, many great stocks go on sale at lower, more reasonable valuations. While you get up to speed reading all the picks that other Foolish writers are suggesting, my recommendation is getting started via an exchange-traded fund, or ETF.

The importance of staying the course

With the market down -25%, some investors might be keen to “buy the dip.” While this approach could work out in the long-term, there is always the possibility of a further correction in the short-term. Investors looking to buy the dip should be aware of this and be prepared to accept some level of risk.

For example, during the Dot-Com Bubble, the U.S. stock market experienced a peak-to-trough loss (drawdown) of -44.11% from September 2000 to September 2022. An investment of $10,000 would have fallen to around $5,837 at the lowest point.

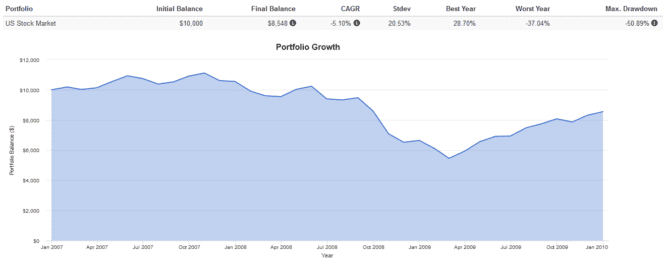

The Great Financial Crisis was even worse. During this period, the U.S. stock market experienced a peak-to-trough loss (drawdown) of -50.89% from November 2007 to February 2009. An investment of $10,000 would have fallen to around $5,457 at the lowest point.

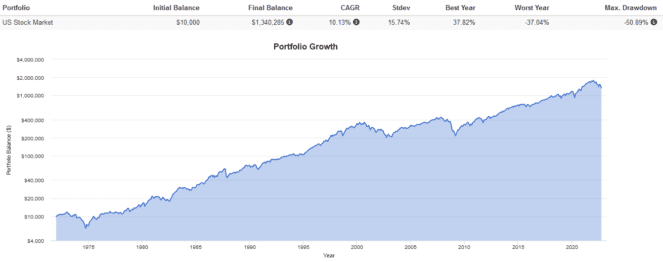

A good maxim I like to remember is “when in doubt, zoom out”. As we all know, the market bounced back consistently to deliver strong returns. Case in point, from 1972 to present, the U.S. stock market has returned 10.13% annualized despite many corrections and crashes.

How to invest when the market is down

The lesson here is to diversify your portfolio and stay the course. A great way to do this is via low-cost, passively managed, broad-market index ETFs.

I like the Vanguard Total U.S. Stock Market Index ETF (TSX:VUN). This ETF holds over 3,500 large, mid, and small-cap U.S. stocks from all 11 stock market sectors. It tracks the CRSP U.S. Total Market Index, which is what I used for the earlier back tests. Around 82% of the Index is dominated by the large-cap stocks found in the S&P 500, with another 12% in mid-caps, and 6% in small caps.

Best of all, it’s very cheap with a 0.16% management expense ratio (MER). For a $10,000 investment, this works out to around $16 in annual fees.

The diversification and breadth that come with owning ETFs make them smart buys even in uncertain times. ETFs also eliminate the headache that comes with researching and selecting individual stocks. And ETFs like VUN that track the broad market will never steer you wrong as long as you’re willing to think long-term. Since operating earnings tend to expand over time, major U.S. indexes, like the S&P 500, will eventually gain value.