Your Tax-Free Savings Account (TFSA) is an excellent place to hold high-growth investments. Capital gains and dividends earned here are non-taxable, making it a great way to maximize your total returns.

While reading up on all the great picks that the other Foolish writers have recommended, my suggestion is plopping your annual $6,000 TFSA contribution limit in an exchange-traded fund, or ETF.

Today, I’ll be going over two high-growth, low-cost ETFs that track different U.S. stock market indexes. Both of these ETFs have provided high historical returns and make for great core holdings.

The S&P 500

The benchmark for the U.S. stock market is the S&P 500. This index tracks 502 blue-chip U.S. stocks and spans all 11 stock market sectors, with a concentration in technology, financials, and consumer cyclical stocks. It is extremely difficult for even professional investors to beat over the long run.

The easiest way to invest in the S&P 500 in Canada is via Vanguard S&P 500 Index ETF (TSX:VFV). VFV is Canada’s most popular S&P 500 index fund and is currently down -17.90%. Investors brave enough to buy the dip could potentially snap up shares at a historically low price.

In terms of fees, VFV will cost you a management expense ratio (MER) of 0.09%. This is the annual percentage fee deducted from your investment. If you invested $10,000 in VFV, you could expect to pay around $9 in fees per year, which isn’t much considering it holds 502 stocks!

The NASDAQ 100

If you’re bullish on tech stocks, particularly mega-cap ones, the NASDAQ 100 might be a better buy. This index tracks the 101 largest companies listed on the NASDAQ exchange, excluding financial companies. Compared to the S&P 500, it has higher return potential but also greater volatility.

The most popular way for Canadian investors to buy the NASDAQ 100 is via iShares NASDAQ 100 Index ETF (TSX:XQQ). Year to date, this ETF is down over 32% due to rising interest rates and high inflation hurting its growth stocks. The current correction could be an excellent entry point.

In terms of fees, XQQ will cost you a MER of 0.39%. This is much higher than VFV, so if your goal is to keep fees minimal, VFV might be preferable. If you invested $10,000 in XQQ, you could expect to pay around $39 in fees per year, which is still cheap compared to actively managed funds.

The Foolish takeaway

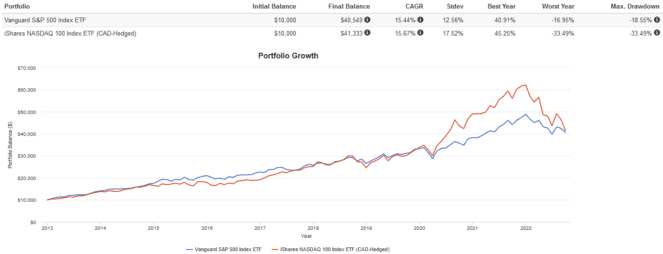

VFV or XQQ could be a great way to supercharge your TFSA’s performance. In terms of historical performance, here’s how both ETFs have returned since 2013:

We see that XQQ pulled ahead strongly during the 2020-2021 bull market but fell harder in 2022 with greater volatility. Keep this in mind before you make your choice!