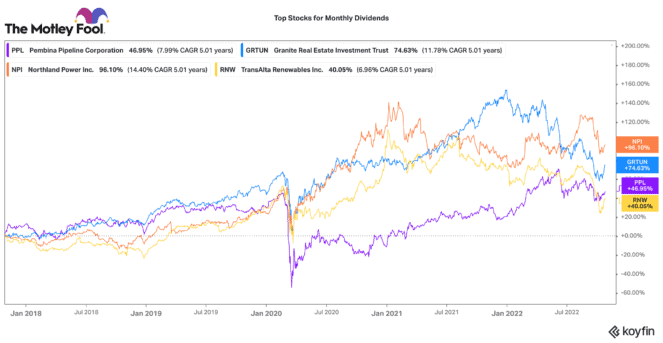

If you want to get some juicy monthly dividends, now is the time to buy top Canadian income stocks. As interest rates have risen, valuations for income-producing stocks have plunged. Likewise, in many instances, their dividend yields are trading near multi-year highs.

Sectors like energy/energy infrastructure, real estate, renewables, and industrials pay attractive monthly dividends. If you are looking for smart dividend stocks that pay reliable monthly dividends, here are the stocks and sectors you want to look at.

Energy infrastructure stocks for monthly dividends

Pembina Pipeline (TSX:PPL) is a great dividend stock, because its monthly dividend is covered by its predictable and contracted pipeline cash flows. Even in the 2020 oil meltdown, it continued to pay its monthly dividend (unlike several other energy peers).

Today, Pembina is very well positioned. Oil demand and pricing is strong, so that also translates to higher demand for energy infrastructure. The company has several growth projects in the midstream and energy export segments (including a potential LNG facility) that could be accretive in the coming years.

Pembina stock has pulled back 7% in the past six months. It earns a very attractive 6% dividend yield today. It just raised its dividend over 3%. Put $10,000 in Pembina stock, and you’d earn $50 in monthly passive income. Keyera, with a 6.6% yield, could also be an alternative, but its longer-term returns have not been as good as Pembina’s.

Real estate is great for monthly income

Real estate investment trusts (REITs) collect contracted monthly lease revenues, so they can pay generally well-covered dividends. Granite REIT (TSX:GRT.UN) is a preferred REIT for several reasons.

Industrial real estate continues to be one of the fastest-growing real estate asset classes. Trends such as on-shoring/re-shoring, e-commerce, and just-in-case inventory are all contributing to strong industrial property demand.

This is evident in the 20-25% rental rate growth that Granite expects in 2023. This should translate into solid high-single-digit funds from operation (FFO) per-unit growth this year and next.

Despite, this dividend stock is down 33% this year. It trades with a 4.4% dividend yield. A $10,000 investment would earn $36 a month. Other attractive real estate stocks with monthly dividends include Dream Industrial REIT (6.2% yield) and Summit Industrial REIT (3.2% yield).

Renewable stocks pay monthly dividends

Northland Power (TSX:NPI) and TransAlta Renewables are two renewable power stocks that pay monthly dividends. While TransAlta is cheaper, and it pays a higher dividend yield (6.6%), it has been plagued by operational challenges and stagnant growth.

Northland Power is a top 10 offshore wind power developer in the world. Sustainable energy demand is incredibly high, and Northland’s development pipeline is very strategically located (Poland, Germany, Scotland, and Asia).

In 2022, earnings have been strong on high power prices and good operating performance. As the company completes its project backlog, shareholders should see earnings double.

Today, Northland pays a 3% dividend. A $10,000 holding in its stock would earn $25 a month. A $10,000 investment in TransAlta Renewables would earn $55 a month (substantially higher), but capital upside may be less than Northland’s.