I don’t actually advocate for “buying the dip.” I’ve realized that market timing is very hard to pull off consistently, so my personal strategy is to invest consistently regardless of how the market is doing. Still, there are times where great stocks go on sale at bargain prices.

2022 might very well be one of these times, especially for the U.S. market. While the TSX did comparatively well due to its high concentration of outperforming energy sector stocks, the same cannot be said for the U.S. market, which is down heavily year to date.

Year to date, benchmark U.S. sectors like the S&P 500 are down over -20%, trading firmly in bear market territory. The culprit? It’s down due to rapid increases in interest rates and sticky inflation that pummeled the many large-cap technology sector growth stocks in these indexes.

In particular, the mega-cap and tech-heavy NASDAQ 100 index is currently down over -34% year to date, putting it right back at levels not seen since July 2020, before the last bull run. Brave investors might be able to exploit this potential buying opportunity via an exchange-traded fund, or ETF.

A brief history of the NASDAQ 100

The NASDAQ 100 index has a bit of a boom-or-bust reputation. Comprised of the largest 101 non-financial stocks listed on the NASDAQ exchange, it has become regarded as the benchmark for large-cap U.S. technology and growth stocks. As such, it is highly sensitive to economic variables.

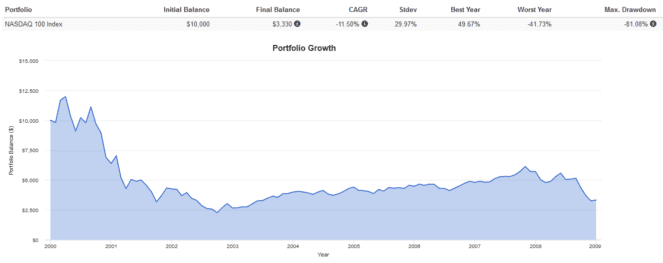

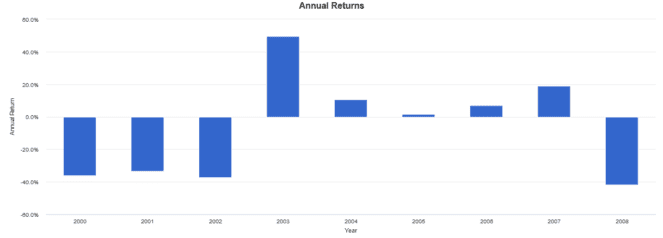

As seen in the below backtest, the NASDAQ 100 fell hard for three consecutive years (2000, 2001, and 2002) as a result of the Dot-Com bubble, losing -36%, -33%, and -37% each year, respectively. It also lost -41% at the height of the 2008 Financial Crisis. From 2000 to 2008, the NASDAQ 100 returned an annualized -11.50%.

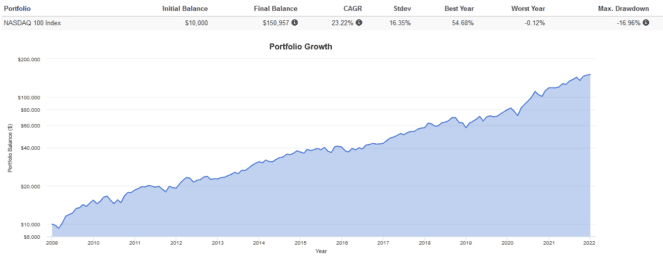

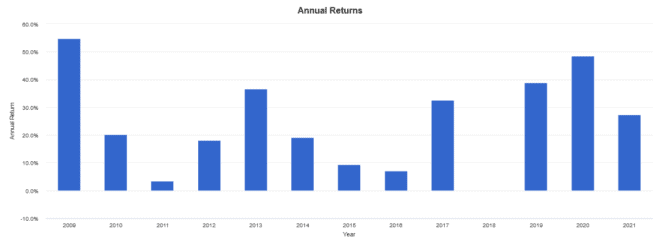

The story changed during the decade from 2009 to 2021, where the NASDAQ 100 roared back to life, riding the success of many FAANG stocks to achieve a 23.22% annualized return. In particular, the NASDAQ 100 returned 48% in a single year during the low-interest bull market of 2020.

How to buy the NASDAQ 100

As noted earlier, the NASDAQ 100 is down -34% year to date in 2022. Is there more downside on the horizon? I don’t have a crystal ball, so I can’t say. What I can note is that the index is back at the levels seen before the 2020-2021 bull run, and over the long term, the index has returned positive.

Logically, if I would have bought back then, I would probably be willing to buy now. The composition and fundamentals of the index have not changed significantly since then. Only the macro-economic environment has due to rising interest rates and inflation.

A great way to buy the NASDAQ 100 index without exchanging CAD for USD is via an ETF. The Canadian stock market has multiple ETFs that track the NASDAQ 100 index. For an annual management expense ratio of anywhere from 0.20% to 0.39%, investors can buy the following NASDAQ 100 ETFs:

- BMO NASDAQ 100 Equity Hedged to CAD Index ETF (TSX:ZQQ)

- iShares NASDAQ 100 Index ETF (CAD-Hedged) (TSX:XQQ)