The pandemic has been especially hard on businesses that rely on people getting together. This is why Cineplex (TSX:CGX) stock has been a disaster. But today, Cineplex’s stock price is on the road to recovery, as it forges its way into the future. It’s also painfully cheap, as investors have not yet fully clued into the new, more promising environment that Cineplex finds itself in.

Here are three reasons why it’s exactly the right time to buy Cineplex stock today.

Rising from the ashes

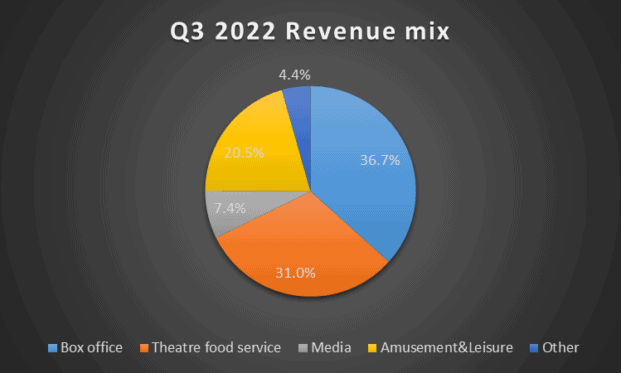

The proof is in the pudding. After two-and-a-half years of struggling, Cineplex is showing us that its diversified business can and will thrive. Cineplex is Canada’s largest movie exhibition company and an all-around entertainment giant in the Canadian landscape. The movie exhibition business accounts for 70% of Cineplex’s revenue. Cineplex’s other businesses, such as the leisure and entertainment and media businesses, account for the remainder.

Cineplex stock has been put through the ringer in the last two years. But the value that has been uncovered is massive. What if I told you that Cineplex stock, CGX, is now trading at ridiculously depressed valuations from a long-term perspective? These valuations include a price-to-earnings (P/E) ratio of 10 times next year’s expected earnings (which may be conservative).

An earnings multiple of 10 times is quite low considering that Cineplex’s business is rapidly recovering. Last quarter, revenue increased 30% and adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) rose 90%. Also, earnings per share (EPS) increased to $0.43 per share compared to a big loss last year and compared to expectations for a loss of $0.17. Let’s also take 2018 earnings as an example of the long-term value that exists here. EPS in 2018 was $1.22 — Cineplex stock is trading at only eight times this earnings number.

CGX stock: Rapid growth ahead

In Cineplex’s latest quarter, results showed real strength, as they’re fast approaching pre-pandemic levels. For example, while box office results were challenging due to issues with content, box office revenue was 70% of 2019 levels. Also, Cineplex’s amusement and leisure segment, which now accounts for 20% of total revenue, is reporting record results. Revenue increased 30%, and stands at 119% of 2019, or pre-pandemic, levels. In addition to this, margins and EBITDA were very strong.

This can only lead us to one conclusion: Cineplex’s stock price is rapidly on its way higher. Thus, it’s 100% the right time to buy today.

The new Cineplex will come out stronger than ever

As I’ve touched upon earlier and in my many articles about Cineplex, this is a rapidly changing company. And it’s changing for the better. It’s now a well-diversified entertainment company with many different segments. So, its fortunes are not 100% tied to the box office. Also, within its movie exhibition business, Cineplex has also taken steps to diversify. This means showing international movies, for example. It also means offering different experiences for movie-goers. For example, VIP theatres create a new experience. For a premium-priced ticket, movie-goers get a little pampered. And Cineplex benefits from higher revenue and margins.

Also, the landscape for Cineplex is changing rapidly. While streaming services were once thought to be the death of Cineplex, the truth is actually proving to be quite different. All involved seem to have realized that one will not really replace the other — they should instead work together for their mutual benefit. Evidence of this came a little while ago in Cineplex’s agreement with Netflix and the theatrical release of Netflix’s movie, Glass Onion: A Knives Out Mystery. The theatrical window will be short, but this is a very important step nonetheless.

According to Cineplex’s chief executive officer (CEO), it reflects the fact that streaming companies have released that the attempt to shorten theatrical windows and focus on subscriber base does not provide a competitive return. A theatrical release is valuable, as exhibition drives marketing, awareness, and interest. As Cineplex’s CEO so nicely put it, “it’s the engine that drives the train for content producers.”