A surprising 71% of Canadians say saving for retirement is a challenge, according to a 2021 survey by BDO Canada. This group makes few contributions to a Tax-Free Savings Account (TFSA), Registered Retirement Savings Plan (RRSP), or even a group plan at their workplace.

I’m sympathetic to the struggles many Canadians are facing with the increasing cost of living. Inflation and rising rates have wreaked havoc on not only portfolios but also budgets. When you’re living paycheque to paycheque, investing for retirement can be the last thing on your mind.

Still, investing even modest sums into the stock market can help you achieve a successful retirement. The key to success is by passively investing in low-cost exchange-traded funds, or ETFs, that track stock market indexes like the S&P 500. Let’s see how this approach would have worked out historically.

Why the S&P 500?

I could go on and on about how the average stockpicker underperforms the S&P 500, but instead, I’ll let Warren Buffett sum it up nicely. In an interview with CNBC in 2017, Buffett said:

“Consistently buy an S&P 500 low-cost index fund. I think it’s the thing that makes the most sense practically all of the time. Keep buying it through thick and thin, and especially through thin.”

The S&P 500 is very hard to beat for retail and professional investors alike. With all the research and time that stock-picking entails, buying a low-cost S&P 500 index fund is simple and easy in comparison.

It also offers good diversification. With 500 large-cap U.S. stocks held, the S&P 500 offers investors a one-click solution to buying some of the top stocks on the market. Trying to buy each individual company would require not only a lot of money, but also a lot of time.

A historical example

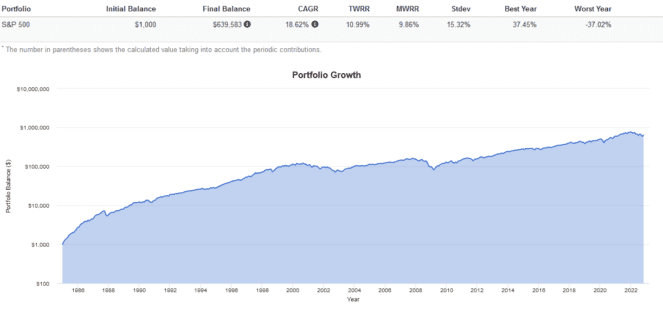

Assume the year is 1984 and you’re a recently graduated 22-year-old university student with only $1,000 in disposable income to your name. You invest it all in a low-cost S&P 500 index fund and commit to contributing $100 every month thereafter for retirement.

You stay the course and hold for the long term, reinvesting all dividends, and never panic-selling despite crashes in 1987, 2000, 2008, and 2020. After 38 years, at age 60, you would’ve turned that initial $1,000 into $639,583.

Keep in mind that this hypothetical return assumes all contributions are made on time, with all dividends reinvested promptly. It also does not factor in trading commissions or fund fees, so make sure you keep those as low as possible!

If you increased your contribution size or rate, your final portfolio value would have been even higher. If you’re behind on retirement, consider cutting down on discretionary spending and putting more into your investment portfolio whenever you can.

Which ETFs to use?

The choice of which S&P ETF to use boils down to one factor: low costs. Because most S&P 500 ETFs are passively managed and expected to perform the same, shop around for the cheapest one.

My favourite S&P 500 ETF is the BMO S&P 500 Index ETF (TSX:ZSP). ZSP costs an expense ratio of 0.09%. For a $10,000 investment, this works out to around $9 in annual fees, which is very affordable.

You can buy the ZSP on virtually every Canadian brokerage platform. Automating contributions and purchases can help you set up a painless retirement investing strategy.