2022 has been a rough year for retail investors. Numerous market corrections, high market volatility, and even a bear market for U.S. tech stocks have rattled many. With more uncertainty on the horizon, some investors might even be considering selling their stocks and going to cash.

Their thought process here is that by doing so, they can avoid further losses. Their goal is to buy back in when the markets have hit a bottom. This is foolish (no pun intended) for many reasons. Firstly, nobody has a crystal ball. We don’t know where the markets are going.

Secondly, this is simply a form of market timing. With this approach, you’re likely to sell low and buy high. At the Fool, we endorse a different philosophy that’s centered on holding a diversified portfolio of high-quality stocks long term. Here’s what investors should do instead.

Market volatility, corrections, and crashes are normal

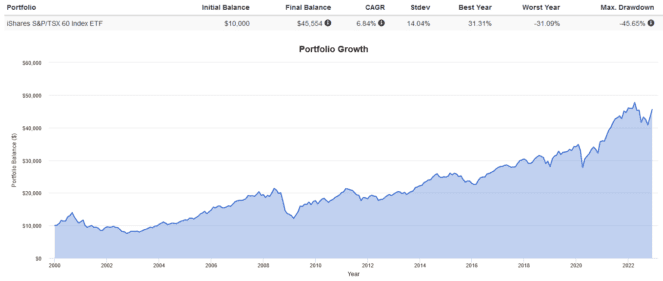

I think a history lesson is a good way of illustrating the importance of staying diversified and invested for the long term. Let’s use the popular iShares S&P/TSX 60 Index ETF (TSX:XIU) as an example.

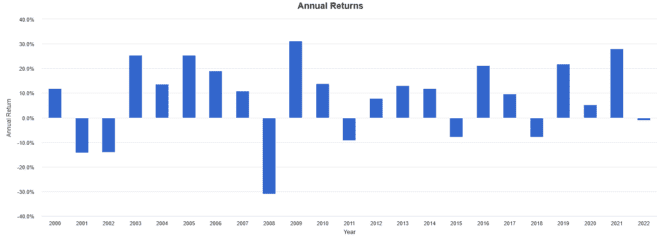

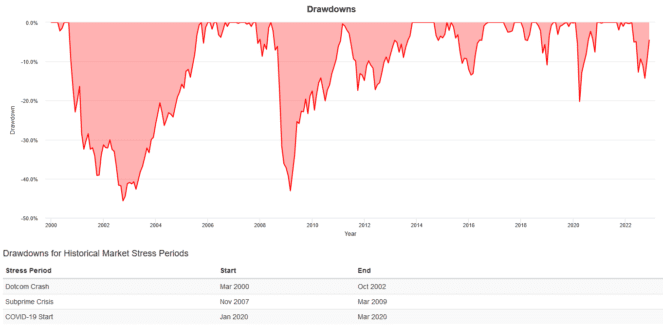

An investor who’s held XIU from 2000 to present would have dealt with some pretty bad losses at various points. For example, XIU lost 14.27% and 14.02% consecutively in 2001 and 2002. Then it lost -31.09% during the 2008 Great Financial crisis. Then there were corrections in 2011, 2015, and 2018.

Here’s a chart that gives you a sense of what XIU has historically lost during various historical market stress periods and how long it took to recover from each:

Why these unrealized losses didn’t matter

XIU holds 60 of the largest, highest-quality, blue-chip stocks in the Canadian market. In fact, it is arguably the Canadian market, given its status as a benchmark for Canadian market performance. Investing in the entire market via index ETFs like XIU is one of the safest ways a Canadian can invest.

Yes, there is high volatility. That’s par for the course for investing in stocks. But the risk of XIU dropping for years or even decades to never recover is remote. The risk of it being delisted is virtually impossible. This is because XIU is diversified. This is why holding a single stock or a few is highly risky.

I could go on and on about why index ETFs like XIU are a great investment, but I’d rather let the chart tell the story. From 2000 to present, XIU has delivered a 6.84% annualized return, despite all of the crashes and corrections noted earlier.

Yes, you could make more from “diamond handing” a single stock, but you could also stand to lose it all. The risk of ruin is not worth it. A good alternative? Hold an ETF like XIU as the core of your portfolio and supplement it with a few choice stock picks.

Instead of panic-selling to cash in and trying to time to market, consider diversifying your portfolio, maintaining a long-term perspective, and staying the course.