Albert Einstein once called compound interest “the eighth wonder of the world”. Young investors who reinvest dividends and stay the course can get rich slowly as their portfolio gradually snowballs.

At the Fool, we endorse a similar investing philosophy. Simply put, the Fool method involves picking high-quality stocks and maintaining a long-term perspective. With this approach, anybody can win in the stock market.

Today, I’ll show you how this approach would have worked out historically. I’ll be using the S&P 500 Index as an example, and then providing some examples of exchange-traded funds, or ETFs that track it.

Image source: Getty Images

Why invest in an index fund?

Stock picking can be hard. While it can be a fun hobby and lead to beating the market, it can also be time-consuming and result in underperforming the market.

Investing in an index fund offers a painless alternative that requires less research and knowledge. With this approach, you’re seeking to match the average return of a well-known market index.

A popular option here is the S&P 500 Index, which tracks 500 large-cap U.S. stocks. It’s seen as a barometer for U.S. market performance and benchmark for investors to beat.

Over long periods of time, very few investors – professional or retail – manage to consistently beat the S&P 500. By investing in S&P 500 index funds, you get a great portfolio of stocks at a low cost.

An historical example

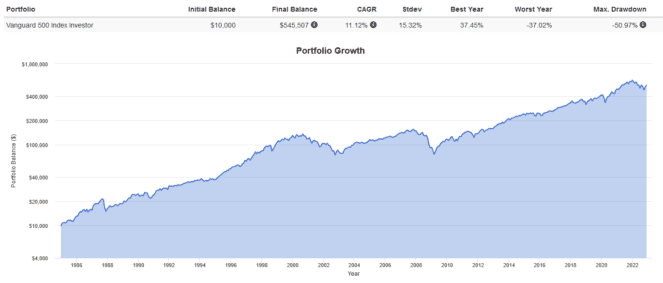

Imagine you started investing back in 1985 as a 22-year-old with just $10,000. You put it all in an S&P 500 index fund and vowed to hold no matter what happened in the markets, and reinvest any dividends promptly regardless of the current price.

Fast forward 37 years later, your humble $10,000 investment would have grown to $545,507 at an 11.1% annualized rate of return without any additional contributions.

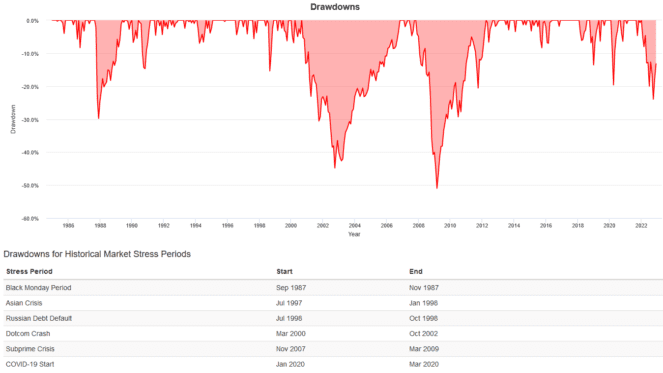

All you did was hold and reinvest dividends. You didn’t panic sell or try to time the market when Black Monday hit in September 1987, the Dot-Com Crash happened in March 2000, the Great Financial Crisis started in November 2007, or COVID-19 crashed the market in January 2020.

Of course, this assumes perfect investment behaviour. The S&P 500 is a fantastic vehicle to grow wealth, but you must remain disciplined and maintain a long-term perspective. Its high rate of growth is of no use if you panic-sell at the first sign of volatility or during a bad crash.

Interested in investing in the S&P 500? The following Canadian-listed ETFs provide exposure to the index at very low management expense ratios:

- Vanguard S&P 500 Index ETF (TSX:VFV)

- iShares Core S&P 500 Index ETF (TSX:XUS)

- BMO S&P 500 Index ETF (TSX:ZSP)