There’s been a lot of talk about passive income on the internet lately. With tech stocks crashing, dividend stocks have come into vogue. Today, people prefer to try for passive dividend income rather than “moon shot” gains, as dividend stocks have been doing better than growth stocks this year.

Whether these passive-income opportunities are real or not is debatable. Generally, the idea that you can earn passive income with no savings is false: you need to invest tens or even hundreds of thousands of dollars to get appreciable dividend cash flow going. However, it is true that dividend stocks do pay you some money for owning them. So, I figured I’d go ahead and reveal exactly how much I, personally, am bringing in in passive Tax-Free Savings Account (TFSA) income each year.

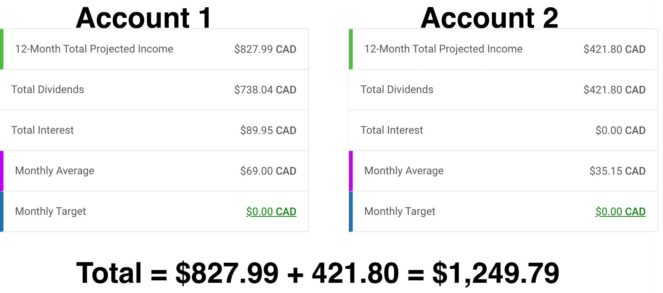

To cut a long story short: the amount is approximately $1,250 per year. It’s from a combination of dividends and interest (mostly dividends), and it has been steadily increasing as I’ve added to my dividend positions this year. I’ve posted screenshots of my two main accounts that pay dividends: as you can see, they pay $1,249 per year combined. I have another smaller account that brings in $5 per year in dividends, bringing the total to $1,254.

How’d I get to this level of passive income?

If you’re looking at the passive income above and wondering how I got it, it took about three-and-a-half years of saving and investing. I’m not going to disclose my portfolio value here, but I have a mix of both dividend stocks and non-dividend stocks.

If I exited all the non-dividend paying positions and invested the proceeds into the dividend stocks I own, I’d be collecting about $2,500 per year in dividends and interest. I’ve chosen not to do that, because I’ve researched all the positions I own thoroughly and believe the non-dividend stocks I own can deliver strong total returns.

Dividend stocks I own: Two examples

I get dividends from about eight stocks and funds in total. In this article, I will explore two of the highest-yielding ones: Bank of America (NYSE:BAC) and Toronto-Dominion Bank (TSX:TD).

Bank of America is a big U.S. bank. I hold its stock in my Registered Retirement Savings Plan (RRSP) and my TFSA. In my RRSP, I pay no taxes on the stock at all (I’ll have to pay some taxes when I retire), in my TFSA, I pay just a small 15% dividend withholding tax.

Bank of America stock has a 2.7% dividend yield. The yield has the potential to rise over time. Interest rates are rising this year, and that’s leading to a big explosion in net interest income at Bank of America. Net interest income means loan interest earned minus deposit interest paid. In the most recent quarter, BAC’s net interest income grew 24% year over year. If the bank keeps up this growth, then it could raise its dividend in the future.

It’s a similar story with TD Bank. In its most recent quarter, reported earnings increased 76% and adjusted earnings increased 5%. “Reported earnings” means earnings calculated by standard accounting rules, adjusted earnings means earnings that are calculated a little differently. TD’s most recent quarter saw a lot of one-time gains due to its pending First Horizon buyout. These gains won’t occur in the future, so TD Bank included adjusted earnings that don’t include them.

TD benefits from rising interest rates, just like Bank of America does. The Bank of Canada is raising rates this year, so TD could see its interest income continue to rise.

In addition to the two stocks mentioned above, I own a number of funds and stocks that pay small dividends. The two names above account for the majority of my dividends, as they have the highest yields. I could be getting more dividend income than I’m actually getting, but I have chosen not to. Sometimes, non-dividend stocks offer great total returns.