John Bogle, pioneer of the index fund and founder of Vanguard, once said that “gunning for average is your best shot at finishing above average.” What he meant by this was that the majority of actively managed funds and stock pickers would fail to beat a simple index fund.

By buying an index fund, reinvesting dividends, staying the course, and holding for the long term, investors can get rich slowly. Albert Einstein once called compound interest “the eighth wonder of the world,” and for good reason. The biggest asset young investors have is time.

If you’re tired of watching the up and down movements of the current bear market and want to grow your portfolio in a hands-off, lazy manner, this guide is for you. I’ll show you how investing in a low-cost index exchange-traded fund, or ETF would have played out historically.

The benefits of index investing

Stock picking can be hard. Investors who pick stocks need to consistently make the right calls, have rules to take profits or cut losses, and avoid getting emotional. They need to keep up to date with every corporate action and listen in to earnings calls. Keeping up with the market news can get exhausting.

With an index fund, there is no need for that. A good broad-market index fund will track thousands of stocks, diversified among all 11 stock market sectors, and across all market cap sizes. Your return will always match the market’s long-term average net of fees with this approach.

With an index fund, there’s no need to closely monitor and worry about your holdings. All you need to do is invest consistently, reinvest dividends promptly, and stay the course. It encourages you to stay hands-off and not lose sleep over your investment’s performance.

A historical example

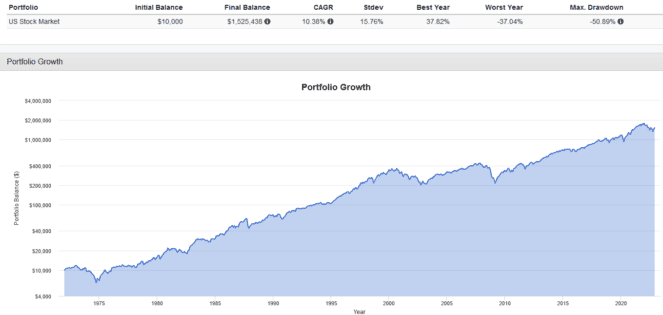

Imagine you started investing back in 1971 as a 22-year-old with just $10,000. You put it all in an index fund tracking the CRSP Total U.S. Stock Market Index, which holds over 3,500 stocks and vowed to hold no matter what happened in the markets, and reinvest any dividends promptly.

Fast forward 51 years later, your humble $10,000 investment would have grown to $1,525,438 at an 10.38% annualized rate of return without you investing anything beyond your initial purchase.

You didn’t have to do any research, read the financial news, listen to earnings reports, or conduct analysis. All you did was buy, reinvest dividends, and hold. The key to success here was trusting that the market’s average return is enough for a long-term investor and avoiding bad behaviours.

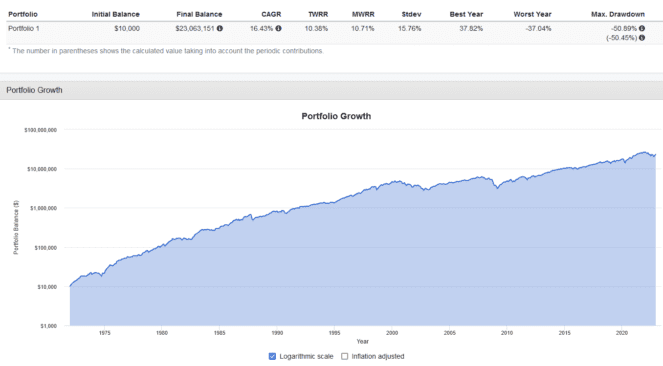

The results would have been even more incredible had you made consistent contributions over time. Here are the results if you had contributed an additional $500 per month, or just $6,000 per year:

The key to success with this approach is picking low-cost, broadly diversified index funds, consistently making contributions, staying the course, not panic-selling, and maintaining a long-term perspective.

A great Canadian ETF to put this strategy into play is Vanguard Total U.S. Stock Market ETF (TSX:VUN), which costs an expense ratio of just 0.16% annually.

Once you have this down, you can spice it up by trying your hand at stock picking. Making the core of your overall portfolio a broad-market index fund and then adding a few choice stocks of your own could be a great hobby and a way of potentially beating the market (and the Fool has some great recommendations below).