“The first million is the hardest,” or so they say. For many new investors just starting out, the thought of their portfolio growing to a seven-figure sum for retirement can seem like an unattainable pipe dream. However, it is entirely possible thanks to the magic of compounding by investing in the stock market.

However, growing your investment portfolio to a million dollars by age 40 is a different story. To achieve this elusive goal, investors should follow the Foolish Investing Philosophy: remain incredibly disciplined, endure volatility, and stay the course, despite corrections, crashes, and bear markets.

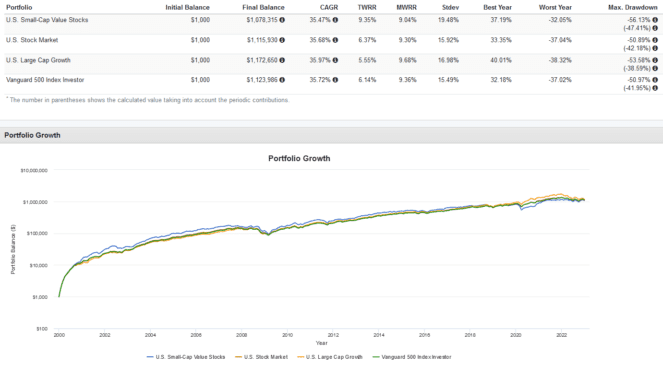

To show you that this approach has historically been achievable, let’s evaluate the performance of four different investment choices from 2000 to 2022: the S&P 500, large-cap growth stocks, the total U.S. stock market, and small-cap value stocks.

The key to becoming a millionaire at 40

Investment selection is important but pales compared to good financial habits. If you want to grow your portfolio to seven figures by age 40, following these key steps is a must:

- Eliminate high-interest debt

- Minimize discretionary spending

- Maximize your monthly investment amount

- Make consistent, frequent contributions

As a young investor, your biggest asset is time. The more time you let your investments go to work, the more value they will produce.

Investment selection can boil down to two factors: diversification and low fees. The first one ensures that your portfolio won’t crash and burn if a single stock or sector performs poorly. The second one ensures more money stays in your pocket.

Here’s a historical example: an 18-year-old investor who started investing in 2000 would be able to reach a million dollars by 2022 if they

- Started with a $1,000 initial investment and contributed $1,000 every month thereafter;

- Invested broadly in a diversified portfolio of U.S. stocks;

- Stayed the course and never panic sold during multiple crashes; and

- Reinvested all dividends on time and never tried to time the market.

Which investments to use

As seen above, using the S&P 500, large-cap growth, small-cap value, or the total U.S. stock market would have worked during this time. Once again, the takeaway is that as long as you stay diversified and keep fees low, the actual investment selection isn’t a big deal. It’s more important to keep your savings rate high and investment contributions consistent. Panic-selling once can derail your plans entirely.

If you want to invest in the four aforementioned choices, a great way to do so is via exchange-traded funds (ETFs). The following ETFs might be suitable:

- S&P 500 index: Vanguard S&P 500 Index ETF

- U.S. stock market: Vanguard U.S. Total Stock Market ETF

- U.S. large-cap growth: iShares NASDAQ 100 Index ETF (CAD-Hedged)

- U.S. small-cap value: Dimensional US Small Cap Value ETF