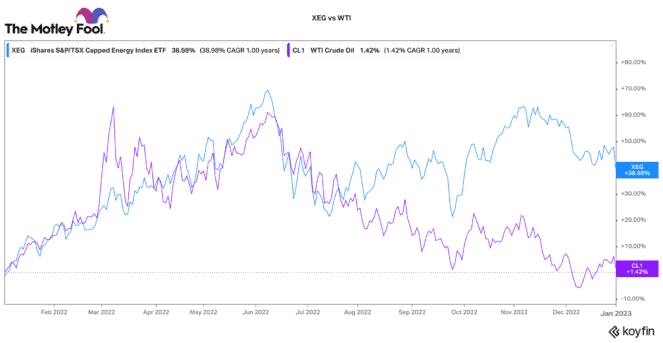

It has been a wild ride for TSX energy stocks over the past year. Oil started 2022 at US$88 per barrel, it shot up to US$120 per barrel after the Russian invasion of Ukraine and landed at US$80 per barrel at the end of the year.

Despite that, the S&P/TSX Capped Energy Index posted a 39% return. TSX energy stocks have been doing all the right things since 2020. They have focused on capital efficiency by improving operations, reducing excess, and lowering debt. Now, many can deliver solid free cash flows and maintain their dividends, even if energy prices were to fall to a more average range.

Prospects for TSX energy stocks still look positive

TSX energy stocks are significantly more resilient than they were just a year ago. Given that global oil supply continues to be constrained and demand is constant, these stocks should continue to earn profitable returns in the years ahead.

Many of these stocks remain extremely cheap when compared to history. As a result, it doesn’t hurt to have some exposure to the sector. Here are two top TSX energy stocks to consider owning in 2023.

Canadian Natural Resources: A giant energy producer

Since November, Canadian Natural Resources (TSX:CNQ) stock has declined 12%. Investors can snatch it up with a nice 4.64% dividend yield. CNQ has been one of the most prolific dividend payers in the Canadian oil patch.

For 22 years, this TSX energy stock has grown its dividend annually by a 22% compounded rate! That is an incredible track record.

It speaks to the quality of CNQ’s assets and its production capabilities. It is the largest energy producer in Canada, and it produces oil and gas with factory efficiency. Its management team own a large stake in the business, so it is incentivized to act in shareholders’ best interest.

This was evident when it raised its dividend twice, and it paid a special $1.50 per share dividend in 2022. As its debt continues to drop, one can expect further cash rewards in 2023.

Tourmaline Oil: A top natural gas stock

Another premium TSX energy stock is Tourmaline Oil (TSX:TOU). Despite its name, it is actually Canada’s largest producer of natural gas. Natural gas has been fluctuating significantly, and that has led to a steep decline in Tourmaline’s stock price. It is down 22% since November.

There are reasons to like this stock. First, it has zero net debt. That means that all excess free cash flow can either be re-invested in production or delivered back to shareholders.

Last year, it paid special and base dividends worth $7.675 per share or an 11% dividend yield. It continues to target around 5% annual production growth.

Second, this TSX energy stock produces at a very low cost and sells its gas to some of the highest priced markets in North America (like California). As a result, it can still do well, even if prices decline to an extent. Lastly, management has a large stake in the company, so incentives are highly aligned with shareholders.

The TSX energy stock takeaway

If you want to play the cyclical energy sector, you are best to own two of the best quality players in the industry. After TSX energy stocks have pulled back in the past few months, you can pick up these stocks at attractive prices and with good prospects for strong dividends ahead.