The Rogers Communications and Shaw Communications merger deal has been extended for a fourth time and remains uncertain. However, Canadian investors who wish to add defensive, relatively low-volatility telecoms stocks to their retirement portfolios may still buy TELUS (TSX:T) stock or BCE (TSX:BCE) stock for a steady passive-income stream and some respectable capital gains for 2023 and beyond. That said, choosing which telecom stock to buy may be a tricky decision, as the two behemoths differ on two very important aspects: current income yields and capital gains potential.

To help with the selection decision, one may compare the telecommunications stocks’ current income yields, potential dividend-growth rates, growth opportunities, and lastly, their current valuations. Let’s have a closer look.

Better dividend play: BCE vs. TELUS stock

BCE is a $55.4 billion telecom giant that has built one of the best 5G networks in Canada and delivers compelling content through owned television networks. The company is larger than TELUS in revenue generation (it reported $24.2 billion in sales in 2022), and it pays a quarterly dividend that yields 6.3%, which is better than TELUS’s current payout.

TELUS is a $39.3 billion telecom innovator that has found new ways of re-engineering revenue growth. Telus stock pays a quarterly dividend that currently yields 5.3% annually. The yield may be lower than that of BCE today; however, TELUS’s dividend has been growing at a higher average annual rate of 6.4% than that of BCE’s (5.1%) over the past three years.

BCE stock’s current dividend yield of 6.3% offers investors a 100-basis point advantage right off the bat. It’s much better than the initial dividend yield on TELUS stock of 5.3% today. The difference in annual dividend income is huge. For example, on a $100,000 new investment, the yield difference could amount to $1,000 every year (being $6,300 minus $5,300). However, TELUS has some capacity to catch up over a long-term investment horizon, and it just might.

Verdict: BCE stock offers better current income, and its average dividend-growth rate is respectable. It’s a better dividend stock for current income right now. Although TELUS has had a higher average dividend growth lately, BCE could maintain a yield advantage for longer than five years.

Best buy for total investment returns: BCE vs. TELUS stock

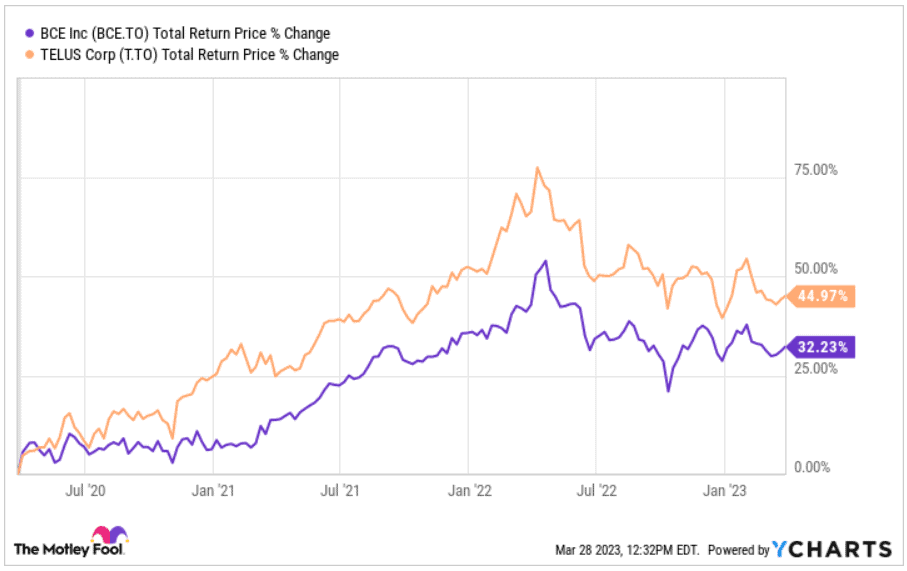

Investments are sometimes best evaluated on their total investment returns capacity. Although the two stocks belong to the same industry and their prices move somewhat in tandem, one has a better capacity to generate capital returns than the other. If you have a long-term view, and you intend to buy and hold either TELUS or BCE stock for the next 10, or more years, then TELUS stock could be your better bet for total holding period returns.

TELUS has found new ways to generate near double-digit revenue-growth rates. Its forays into healthcare, agriculture, and international business services are new growth frontiers that will be more important in giving TELUS stock a capital gains edge over BCE. Telus reported an 8.6% year-over-year growth in revenue for 2022 — more than double BCE’s 3.1% revenue-growth rate during the past year.

Bay Street analysts strongly believe that TELUS could trounce BCE in growing revenues and earnings over the next five years. The five-year earnings-growth outlook for TELUS, at 13.6% annually, is far higher than BCE’s 4.9%.

Companies that generate higher revenue and earnings-growth rates should attract higher valuations, yet TELUS’s forward price-to-earnings (P/E) multiple of 19 times is just a tad higher than BCE’s 17.6. Stellar execution should see TELUS stock generate better price appreciation over the next few years.

Actually, TELUS stock has generated better capital gains for its investors over the past three years, and it’s well set to continue doing so over the next half-decade, too.

Past performance may not reflect future returns; however, TELUS has strong legs to keep running on.

Investor takeaway

Both TELUS stock and BCE stock are good retirement investments to add to a long-term-oriented portfolio. The latter offers a higher current income yield; however, what TELUS lacks in yield, it makes up for in capital gains potential, and investors in TELUS stock could enjoy higher total returns going forward.