Learning about investing can be a fun journey, and I’m here to share some tips and tricks with you but also to dispel some dangerous myths.

Sure, some people might strike it rich with meme stocks or cryptocurrencies, but let’s not forget the wise old saying, “slow and steady wins the race.” For every “to the moon” winner out there, there’s a loser with a blown-up account staring at a -90% or higher loss.

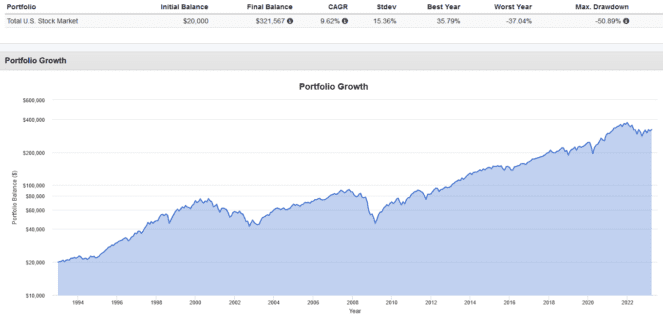

To avoid this, I suggest the age-old practice of diversification. Spread your risk out among many stocks from all market cap sizes and sectors. Instead of trying to pick and choose the winners, consider buying the entire stock market! Here’s a historical example using index funds.

The power of compounding

To be a savvy investor, consider focusing on managing risks, like avoiding high fees, not chasing hot assets, and keeping a high savings and contribution rate. To illustrate this, let’s time travel back to the year 1993 — 30 years ago.

Imagine that you’re 25 years old with $20,000 to invest, and you put it all in a low-cost index fund tracking the entire U.S. stock market. That’s over 3,000 large-, mid-, and small-cap stocks from all 11 market sectors in your portfolio via just a single ticker.

By March 31, 2023, your initial $20,000 would have grown to $329,822, thanks to a 9.62% average annualized return, and you didn’t do anything more than reinvesting dividends and staying the course (e.g., avoiding timing the market and panic selling).

Of course, it wasn’t always a smooth ride. You had to endure big losses during the Dot-Com bubble and the 2008 Great Financial Crisis, which saw your portfolio drop by 50%. However, if you were able to tolerate the volatility and keep a long-term focus, you were handsomely rewarded later.

Keep in mind that this is without any additional contributions. Had you made additional periodic investments, your results would have been even greater.

Which ETFs to use

To index the total U.S. market, Canadians can make use of two Vanguard exchange-traded funds, or ETFs, with one being trading in Canadian dollars and the other trading in U.S. dollars.

In a Registered Retirement Savings Plan (RRSP), consider Vanguard Total Stock Market ETF. As a U.S.-listed ETF, VTI is not subject to the 15% foreign withholding tax on dividends when held in an RRSP. This, along with an ultra-low expense ratio of 0.03% makes it highly cost effective.

In a Tax-Free Savings Account (TFSA), foreign withholding tax is applied on U.S. investment dividends. In this case, investors can save on the foreign exchange costs of buying U.S. ETFs and opt for the Canadian-listed Vanguard US Total Market Index ETF instead, which charges a 0.16% expense ratio.