One common mistake I see Canadian investors commit is yield-chasing. Yes, it can be tempting to snap up stocks with dividend yields above 5%. The feeling of seeing a fat quarterly dividend payment hit your account balance can be powerful.

Yet the obsession over high yields is an example of “missing the forest for the trees.” If your goal isn’t high present income for spending, a high-yield investment strategy may not be ideal.

If the objective is the grow your portfolio long term, I would pivot to focus on dividend growth — specifically, reinvesting that growing dividend. Over time, this can snowball and compound to large returns.

Here’s a historical example using Canadian Tire (TSX:CTC.A).

Canadian Tire’s historical returns

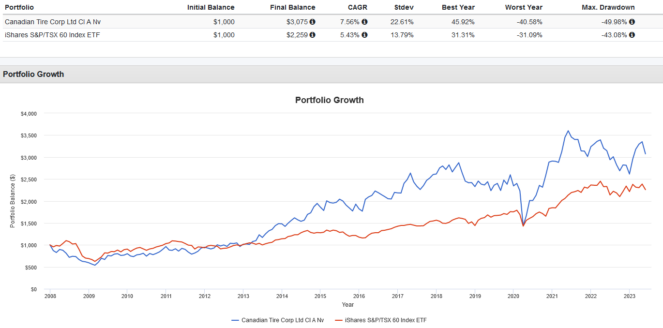

Picture this: the year is 2008, right in the midst of the worst financial crisis and recession we’ve seen in decades. You have $1,000, which you chose to invest in Canadian Tire. You hold this stock diligently over the years, reinvesting dividends promptly on time and never panic-selling.

Fast forward to May 2023, and your initial $1,000 investment would have tripled to $3,075, for an annualized return of 7.56%. This beat the benchmark S&P/TSX 60 Index, which only returned 5.43%. Technically, you beat the market!

Here’s the problem. This is all in retrospect, and hindsight is 20/20. Identifying market-beating stocks like Canadian Tire ahead of time is extremely difficult. The chances of making a poor pick and underperforming the market is equally as likely. So, what’s the solution?

Diversify with an ETF

As always, I would urge diversification. Canadian Tire is a solid company, but at the end of the day it is just one of many quality dividend stocks investors can find in the Canadian market. For easy exposure to a pre-made portfolio of these dividend-growth stocks, consider using an exchange-traded fund (ETF).

My pick today is iShares Canadian Select Dividend Index ETF (TSX:XDV), which tracks the Dow Jones Canada Select Dividend Index.

This ETF holds a concentrated portfolio of Canadian dividend stocks that have the highest yields compared to peers in the broader Dow Jones Canada Total Market Index. Moreover, the ETF has a quality screen to ensure good dividend growth and a sustainable payout ratio.

As a bonus, the ETF’s current top holding is Canadian Tire at 9.22%. You also get exposure to numerous big banks, telecoms, and pipelines. The ETF pays monthly dividends and costs a 0.55% expense ratio.