In 2013, if you’d ventured into the world of Canada’s oil and gas sector with a $5,000 investment in Pembina Pipeline (TSX:PPL) stock, your portfolio would look significantly different today, albeit for the better.

This sector is a well-known playground for those who understand the cyclical nature of the industry, which oscillates alongside global economic trends and commodity price fluctuations.

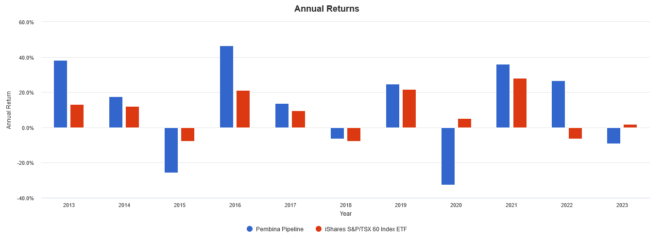

Pembina epitomizes the industry’s ups and downs. Its performance over the last decade has been a volatile ride, exhibiting the resilience amid inflationary pressures, but also vulnerability to changes in commodity prices.

Here’s a look at how a historical $5,000 investment in Pembina at the start of 2013 would have worked out nearly 10 years later and how I would invested instead.

The Pembina roller coaster

Here’s the bottom line up front. If you’d invested $5,000 in Pembina at the start of 2013, your investment would have grown to $12,459 by May 2023 for an annualized return of 9.16%. This beat the market, as the benchmark S&P/TSX 60 index only returned an annualized 8.05%.

There is a catch though: volatility. Pembina’s standard deviation was 25.63% compared to the index at 11.87%. In other words, on average the stock experienced ups and downs over twice as steep as the market.

This translated into an overall poorer risk-adjusted return, with Pembina sporting a Sharpe ratio of 0.45 versus the index at 0.64. Objectively, Pembina has been a poorer investment compared to the broad market.

This volatility was put on full display during the 2020 COVID-19 pandemic, which led to unprecedented worldwide lockdowns, significant drops in demand for oil, and plummeting prices. During this time, Pembina experienced a brutal -47.31% drawdown, making 2020 one of its worst years yet.

What I would invest in instead

Given these results, I would not buy a large stake in Pembina. In my opinion, the high volatility of Canadian energy sector stocks requires diversification, at least among a few players if not with other sectors.

A great exchange-traded fund (ETF) alternative to consider is BMO Equal Weight Oil & Gas Index ETF (TSX:ZEO), which holds Pembina, along with nine other leading Canadian oil and gas stocks in equal weights by tracking the Solactive Equal Weight Canada Oil & Gas Index.

Currently, this ETF pays an annualized dividend yield of 5.01% against a 0.61% expense ratio. Overall, I think ZEO is a much better pick for betting on the Canadian oil & gas sector compared to just buying Pembina.