While I usually find myself at odds with Canada’s bank and telecom oligopolies — thanks to their poor customer service, lack of choice, and noncompetitive fees — I must admit that I have a soft spot for Canadian National Railway (TSX:CNR) and Canadian Pacific Railway (TSX:CP) duopoly.

Maybe it’s because their operations don’t directly affect me as a consumer in the way that banks and telecoms do. Regardless, what really piques my interest is how well this duopoly can work for me as an investor.

Beyond the appealing financial metrics these companies often exhibit, the duopoly situation grants CNR and CP a rare trait that most companies can only dream of — a wide economic moat.

Let’s break down what that economic moat actually means, how it serves as a protective barrier against competition, and why it makes both of these railway stocks compelling investment options.

What the heck is a wide moat?

Warren Buffett, the Oracle of Omaha himself, has frequently emphasized the importance of an “economic moat” when selecting investments.

He has been quoted as saying, “In business, I look for economic castles protected by unbreachable moats.” But what exactly does this metaphor mean in the context of investing?

In simple terms, an economic moat refers to a company’s sustainable competitive advantage that protects it from competition, much like how a medieval castle’s moat protects it from invading armies.

This moat could be in the form of brand recognition, cost advantages, regulatory advantages, or, as in the case of CNR and CP, control over an industry with high barriers to entry.

For example, consider a small lemonade stand with a secret recipe that makes it incredibly popular. If it’s the only stand that knows how to make this special lemonade, it has a “wide moat” because other lemonade stands can’t easily replicate its success and thus steal its customers and market share.

Similarly, CNR and CP operate in an environment where it would be exceedingly difficult and costly for a new competitor to build a rail network and gain the necessary regulatory approvals.

In short, this wide moat acts as a protective barrier, helping the company maintain its market share and pricing power, which ultimately benefits investors.

The effects of a wide moat

For long-term investors, a company with a wide moat offers several key benefits that contribute to more stable and potentially higher returns.

One of the most immediate advantages is pricing power. A strong competitive edge allows these companies to set prices without losing customers to competitors, often leading to higher profit margins.

Case in point: CP currently has an incredibly high operating margin of 41.51%, while CNR sits at 46.59%. Both companies possess a return on equity (ROE) of 11.22% and 24.97%, respectively, signifying that both companies are efficiently using their shareholders’ equity to generate profits.

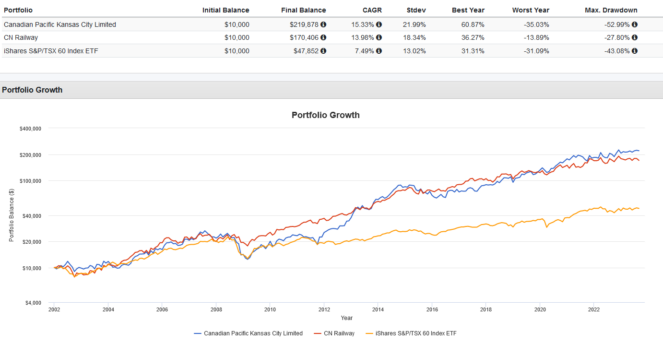

Finally, take a look at the backtest below, which shows CP and CNR outperforming the benchmark S&P/TSX 60 Index from 2002 to the present.

Normally, I don’t feel comfortable picking individual stocks, but I make an exception for wide-moat companies like CP and CNR. In this case, I would simply split the difference and buy both sides of the duopoly.