The SNC-Lavalin Group (TSX:ATRL) is rebranding to AtkinsRéalis. The company has changed its name – even as the reputational risk once associated with its old brand seemed to have cleared. Although the legal name change requires a shareholder vote at an annual meeting in 2024, SNC stock’s new ticker symbol “ATRL” became functional on September 18, 2023. The new identity crowns a spectacular nine months of strong investor returns. SNC stock has almost doubled with a 93.6% price surge so far this year –trouncing most Canadian growth stocks.

The $8.2 billion engineering consulting services firm has carved out a new path to revenue and earnings growth that has seen its stock price print new 52-week highs recently. Given the fine run, the big question for investors today is whether SNC-Lavalin, or AtkinsRéalis, stock remains a good buy at current levels.

Why has SNC-Lavalin stock risen so far in 2023?

Rising profits, new project wins, and backlog growth to a record $12.4 billion have propelled SNC-Lavalin stock to dizzying heights so far this year. The company’s recent stellar performance printed a compelling investment case for new shareholders and existing stockholders alike. Companies basically become more valuable when they make more profit.

SNC-Lavalin’s income statement posted triple-digit earnings growth during the first half of 2023. Revenue increased by 10.5% year over year to $4.2 billion and net income surged by 263% year over year from $25.4 million to $92 million.

The company is more profitable this year than it was in 2022 as it restructures its business and wins new contracts. That said, a massive jump in SNC’s earnings is partially linked to a $27.4 million legal settlement in 2022, which isn’t recurring.

Although this isn’t an alarming issue to note yet, SNC-Lavalin has seen a strong 93% increase in revenue from equity-accounted investments to $29.2 million from $15.1 million. One key issue to note with equity-accounted “revenue” is that: it’s not essentially revenue but a profit share from projects in which the company has influence. No operating expenses are recognized against equity-accounted “revenue.” SNC-Lavalin’s gross, operating, and net income margins may expand further as it grows its equity-accounted investments book.

Should you buy SNC stock after the 2023 rally?

New investors with a long-term view may buy SNC stock with a view to profit as the company turns its record $12.4 billion (and growing) backlog into revenue, expands earnings margins, and does away with a “scandalous” past.

Demand for SNC-Lavalin’s engineering and project management services remains strong in core markets to support strong organic growth. I’m looking at the 18% growth in revenue from the United Kingdom, a key market that generated 31% of its total revenue during the first six months of this year. The UK is the company’s largest single market, and SNC Lavalin is scoring big there. The company also saw a strong 63% surge in revenue from the Middle East to make up 11% of total revenue during the first half of 2023, up from just 7% of sales last year.

Interestingly, SNC stock is yet to reclaim its prior five-year highs. The company hasn’t diluted its shareholders through new share issuances, and a return to past operating levels may support its attempt at prior highs near $60 a share (a potential 28% gain from current trading levels).

That said, although winners usually keep winning, it’s also generally risky to be a new buyer on a volatile stock that has significantly surged – and may be due for some correction.

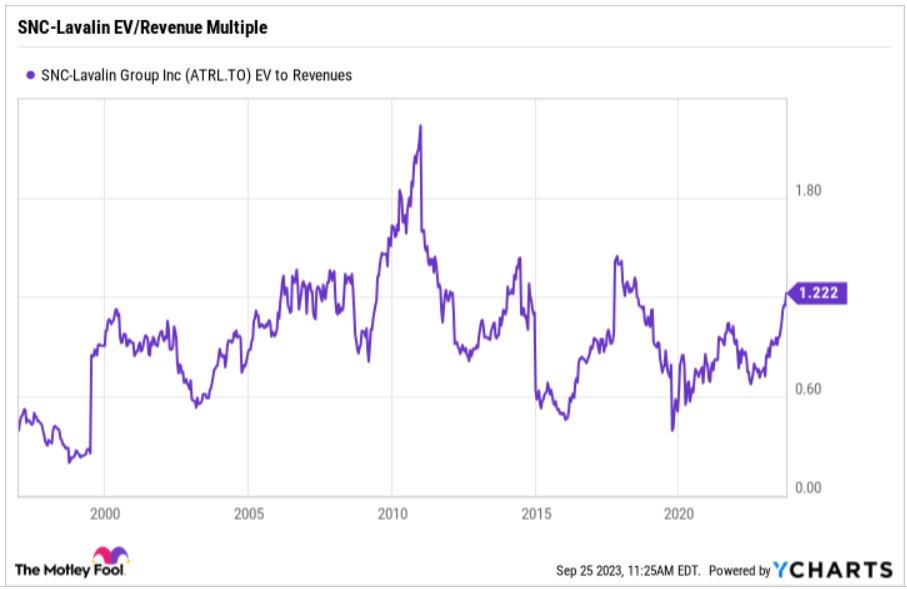

Valuation is increasingly a significant concern on SNC stock at current levels. The company’s forward enterprise-value-to-sales (EV/Sales) multiple of 1.2 has grown past five-year averages of 0.9. The multiple is hovering around the general peaks recorded post-2000 (except in 2010), as seen below.

Enterprise value includes debt in valuing the entire business, and SNC-Lavalin is (justifiably) loading up on new debt in 2023. Slow revenue growth may hurt multiples in the near future. The market expects SNC-Lavalin to grow revenue at single-digit rates below 5% in 2024 and 2025.

If I was holding SNC stock, I’d be tempted to be a seller booking profits at current levels.