Oil is surging again, and top Canadian oil producers including Suncor Energy (TSX:SU) stock are increasingly attractive investments going into the fourth quarter of 2023. The West Texas Intermediate (WTI) oil price benchmark touched a 13-month high of US$95 per barrel on Wednesday, September 27, 2023. Higher oil prices are favourable to a restructured and leaner Suncor, which is under new leadership and under pressure (from institutional and activist investors) to richly reward SU stockholders.

Suncor is a $61.9 billion integrated energy stock that has underperformed peers over the past few years. Suncor stock could have generated “just” 223.5% in total return to shareholders while the iShares S&P/TSX Capped Energy ETF, a top Canadian energy exchange traded fund, potentially generated 348% in total dividend-adjusted returns over the past three years. The historical era of underperformance may be over. The energy giant could energize your portfolio over the next two or more years.

New leadership, lower costs, and investor community pressure to boost Suncor stock returns

Under growing pressure from institutional investors demanding better returns, Suncor installed a new Chief Executive in February this year. During a recent earnings call with analysts in August, new Suncor Energy CEO Richard Kruger mentioned conducting physical and virtual meetings with “several” major shareholders during the second quarter of 2023. The pressure to make shareholders happy is evident, and the new management’s plan could deliver good results.

The new leader is devoted to developing a “simpler, more focused, high-performing organization.” A restructuring plan is underway that seeks to significantly reduce the cost structure, so it retains more cash flow to distribute to investors.

Suncor will have fewer senior executives, as its headcount is reduced by 20% (or 1,500 employees) in 2023, as management plans to reduce above field costs by $400 million each year. Cost reduction efforts may boost Suncor’s operating competitiveness and reduce its breakeven oil price by $1.50 a barrel. The company is already on track, and 535 employees had left the organization by August 1, 2023.

A leaner cost structure, better cash flow generation capacity, a new leadership focused on enhancing shareholder returns, and sustained pressure from activist investors should combine to make Suncor the energy stock to energize your portfolio.

Thanks to stronger oil, there’s no better time for Suncor to restructure its operations than during the good times – that’s because all the additional free cash flow from operations during the high commodity price regime will flow to investors. The company could deliver outperforming returns over the next few years, if oil prices continue to cooperate.

Suncor to reward stockholders with positive returns

Current restructuring efforts, better cash flow generation during the current oil super-cycle, a commitment to reducing debt, share repurchases, and dividend raises should combine to de-risk Suncor stock and unlock outperforming returns to shareholders.

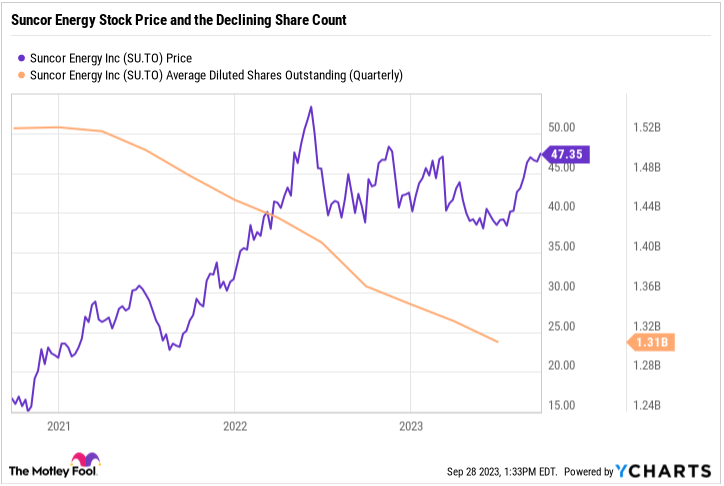

The company closed the second quarter with a $14.4 billion debt balance after paying down $1.3 billion during the quarter. The energy producer returned $1.4 billion to shareholders through dividends ($700 million) and share repurchases ($700 million) during the second quarter. By August, the company had reduced its share count by 3% since January. Suncor has reduced its outstanding shares by more than 14% over the past three years.

Share repurchases enhance total returns on the top Canadian energy stock.

Each common share represents a perpetual claim on the business’ earnings. Due to share buybacks, the existing claims on Suncor’s profits, assets, and cash flows have declined by 3% so far this year. Investors who never sold their positions since January have 3% fewer hands to share commercial benefits with. Their shares are worth much more than they were in January.

Given time, sustained share repurchases could significantly reduce the residual claims on the business’ profits and cash flows. The share price will rise to reflect the growing intrinsic value of each outstanding Suncor common share.

Most noteworthy is the dividend. Suncor stock pays a quarterly dividend that should yield 4.4% or higher over the next 12 months. The dividend should be higher if management follows through with an expected dividend raise for 2024. Bay Street analysts project a 5.5% dividend increase on Suncor stock for the next year.