The Canadian National Railway (TSX:CNR) (or CN Rail) is experiencing a sluggish financial year in 2023. Down more than 9% year to date, CN Rail stock trades near recent 52-week lows printed early October. Investors on the sidelines may be wondering if this is the right time to buy the railroad stock. I’m bullish on CN Rail stock’s long-term upside despite current weakness.

The $96.5 billion rail transportation giant is set to release third-quarter earnings results on October 24. There’s a chance that an updated earnings guidance may trigger some bullish sentiment and make traders happy. Even if the upcoming earnings report disappoints, in a few years from now, long-term oriented investors may wish they bought CNR stock during its current weakness.

Why is CN Rail stock going down in 2023?

Following a record performance in 2022, and a strong show during the first quarter, CN Rail’s revenue and earnings are falling behind prior-year levels in 2023. Second-quarter revenue declined by 7% year over year to under $4.1 billion and adjusted earnings per share fell 8.8% to $1.76 due to lower intermodal revenue, lower crude oil and U.S. grain exports, generally weaker demand for freight services to move consumer goods, and outages caused by Canadian wildfires.

Wildfires persisted well into the third quarter.

Bay Street analysts project worse revenue and earnings performance in the upcoming earnings instalment. Third-quarter revenue could drop 9% year over year and normalized earnings could come in 17.5% lower. Earnings results could get worse before they get better.

Naturally, investors pay less for a business that’s losing sales volumes and reporting shrinking earnings. Understandably, CN Rail stock lost value during the first nine months of 2023.

This could change.

Can shares recover?

Quarterly financial results and near-term expectations influence short-term share prices on CN Rail stock; however, long term-oriented investors look beyond short-term “noisy” performance and into the business’s potential to deliver stellar multi-year results – and CN Rail is a cash-rich business with wide natural moats and persistent efficiency gains that may unlock significant upside for investors who stay the course.

Legendary investor Warren Buffett is a big fan of companies with tangible moats that generate massive amounts of cash flow. CN Rail’s massive clout in moving the North American economy will continue to generate growing free cash flow available to shareholders every year.

And free cash flow growth is key in a CN Rail stock investment thesis.

Watch cash flow

CN Rail continued to generate boatloads of free cash flow in 2023, even as revenue and earnings growth slows. This key quality may sustain positive long-term investor returns on CN Rail stock.

Free cash flow is the discretionary cash from operations, adjusted for sustaining capital expenditures, that management may either reinvest for growth, pay down debt, or distribute to shareholders via dividends and share repurchases.

CN Rail’s free cash flow increased by 10% year-over-year during Q2, and was 8% higher for the first half of 2023 at $1.7 billion. Annual free cash flow topped a record of $4.1 billion in 2021, and Bay Street forecasts a similar figure in a robust 2024.

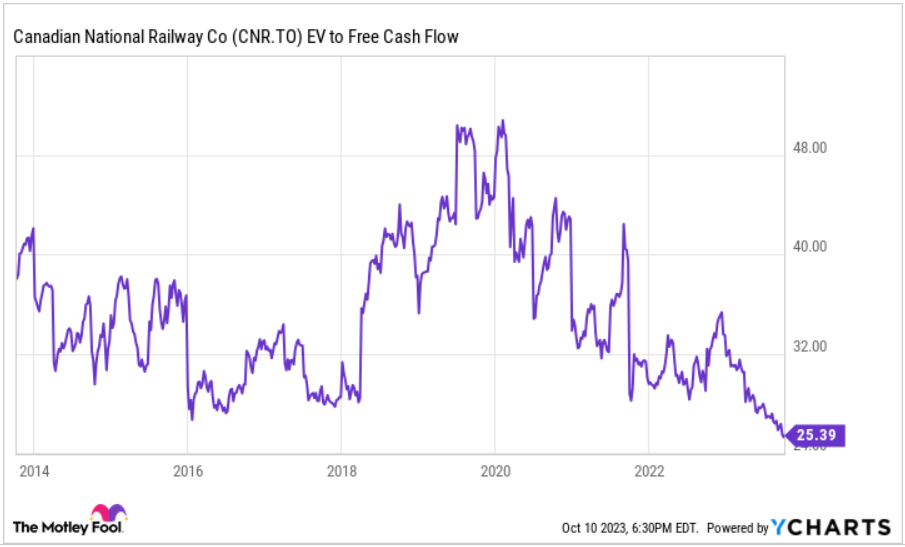

Meanwhile, CN Rail stock trades cheap at an enterprise value-to-free-cash flow multiple around 25 – the lowest cash flow valuation level seen in a decade.

Sustained positive free cash flow generation empowers the company to augment shareholder returns through share repurchases and dividend raises. CN’s share count has dropped from an average of 707 million during the first half of 2021 to about 653.6 million this month. The company is authorized to repurchase up to 4.8% of its outstanding common shares this year.

Lower share counts mean higher earnings per share and growing stock values as remaining shareholders own an increasing stake in the business.

Most noteworthy, the dividend yield on CN Rail stock has creeped higher towards 2.2% – levels last seen during the COVID-19 pandemic market crash of 2020. Management could raise dividends at annual rates above 6% per annum over the next two years.

Time to buy CN Rail stock?

Investors may take advantage of the current discount on the blue-chip CN Rail stock before a return to volumes growth elevates investor enthusiasm in the formidable railroad stock’s ability to richly reward its investors. Higher dividends and sustained share repurchases could augment annual total returns over the coming years.