First National Financial (TSX:FN) is among the highest-yielding financial stocks on the TSX today. With a 6.35% yield, it pays out even more dividend income per dollar spent than many REITs and pipeline companies. TSX financials in general are known for having pretty high yields, but FN is really something else.

The first logical question to ask is, “What’s the problem here?” Usually, stocks with extremely high yields acquire them by being beaten down severely in the market, or paying too high a percentage of their earnings out as dividends. In either case, the high yield signals trouble.

In FN’s case, the stock is actually up slightly for the year, and the company’s payout ratio (52%) is not overly high. It is high by the standards of financials (they usually pay out 50% or less), but it’s low compared to other high-yield sectors like real estate investment trusts and pipelines. So, neither of the “usual culprits” behind high-yield stocks are applicable.

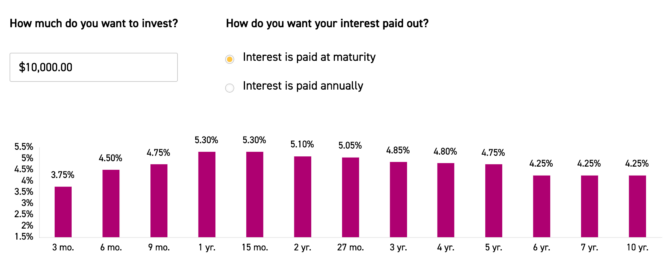

First National Financial’s yield is so high right now that it even beats the mighty Guaranteed Investment Certificate (GIC). You might think of GICs as low-yield “assets” that lose money in real terms — they were that for most of the last decade, but things have changed. Today, you can find GICs yielding 5%, even higher than some of the smaller banks. Such investment certificates have become a mighty force in the markets, forcing investors to consider whether investments in risky assets are worth it. Fortunately, in FN’s case, the dividend yield is still worth it, even with GIC yields on the rise.

GICs yield 5%

When I say that FN stock beats GICs in terms of yield, that’s no minor word of praise. It’s a significant accomplishment. These days, GICs yielding 5% are easy to come by. At times, an investor can even find GICs with 5.5% yields or better. Below is a table of GIC yields from a small bank. As you can see, they are quite high. Nevertheless, the mighty First National beats them all.

First National’s results

Having established the basics of First National’s yield in the opening paragraphs (6.35% yield and 52% payout ratio), it’s time to take a deep look at whether First National can really keep these massive payouts coming.

First, let’s look at the most recent quarter’s earnings. In its most recent quarter, FN delivered the following:

- $142 billion in mortgages under administration (MUA), up 10%

- $8.6 billion in new mortgages issued, up 26%

- $563 million in revenue, up 43%

- $83.6 million in net income, up 108%

- $1.38 in earnings per share (EPS), up 109%

As you can see, the growth was good in the most recent quarter. And what about the longer term? In the trailing 12-month period, this non-bank lender had a 33% net margin and a 38% return on equity. So, its profitability was off the charts. Over the last five years, it had the following compounded annual growth rates:

- Revenue: 9.51%.

- EPS: 7%.

- Assets: 4.9%.

- Book value: 7.1%

Foolish takeaway

The economy right now is very favourable to lenders. Yields are high, yet inflation is falling, so expectations of a recession are declining. The yield curve will likely flatten and then steepen. So, First National will probably be able to keep paying its generous dividend. I don’t think this year’s earnings extravaganza will be repeated, but results should be sufficient to keep the dividend coming.