The 4% rule has long guided retirees on how much they can safely withdraw from their portfolio without running out of money. It suggests taking out 4% of your savings in the first year of retirement and then adjusting that amount for inflation each year after. This rule aims to make savings last for about 30 years.

But following this rule has led some people to focus too much on finding investments that pay high returns, like certain ETFs or stocks that offer more than 5% in dividends. This approach, known as yield chasing, can be risky. It might seem like a good way to ensure you have enough income, but it can actually lead to bigger problems, like losing money if those high-paying investments don’t perform well.

Chasing after high yields just to stick to the 4% rule isn’t the best idea. It’s better to consider your entire investment’s growth, not just the cash it pays out. I’ll explain why focusing only on high yields can be a mistake and what you should do instead to manage your retirement savings wisely.

A historical example – the assumptions

Let’s get straight to the point: focusing on yield alone can actually set you back in your investment journey, especially when adhering strictly to the 4% rule for retirement withdrawals.

It might seem logical to aim for investments that offer a 5% yield to cover your 4% withdrawal needs comfortably, but this strategy could mean missing out on greater financial growth.

Imagine two investors, both retiring in 2011 with $1 million each. The first investor decides to put their money into the iShares Canadian Financial Monthly Income ETF (TSX:FIE), attracted by its financial sector stocks, preferred shares, and corporate bonds that generate a high 6.95% yield as of February 9.

The second investor opts for a mix, choosing 60% in the iShares MSCI World Index ETF (TSX:XWD) and 40% in the iShares Core Canadian Universe Bond Index ETF (TSX:XBB). The yield from these ETFs doesn’t quite reach 4%, necessitating the occasional sale of shares to fund withdrawals.

A historical example – the results

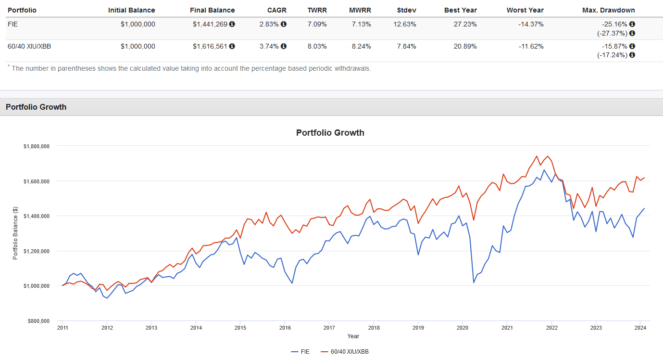

Fast forward to the present, and let’s assess the results under the assumption of a 4% annual withdrawal:

- Investor 1, who leaned heavily into the high-yield FIE, would have seen an annualized return of 2.83%, ending up with $1,441,269. This shows that they managed to grow their initial investment while withdrawing 4% yearly.

- Investor 2, despite having to sell shares periodically due to a lower yield, would have experienced a compound annual growth rate of 3.74%, resulting in a portfolio worth $1,616,561. This outcome surpasses that of Investor 1 by a significant margin.

This example underscores that it’s the total return, combining both price appreciation and dividends, that truly matters in the long run. A high dividend yield might seem appealing as it appears to offer “free money,” but it doesn’t guarantee the best overall financial growth.

Total return should be the focus, ensuring that both the income generated and potential for capital appreciation are considered in your investment strategy.