When it comes to investing in the stock market, U.S. investors often seek a straightforward and effective strategy. Among the plethora of options, the Vanguard Total Stock Market ETF (NYSEMKT:VTI) stands out as a popular choice for those who favour the “VTI and chill” approach.

This method simplifies investing into a single, comprehensive move – buying shares of VTI, which holds over 3,500 U.S. market stocks. But why does this ETF attract so much attention and loyalty? The answer lies in its potential to be a millionaire maker.

While some may approach this claim with skepticism, a dive into the historical data reveals compelling evidence of its potential to substantially grow an investor’s wealth over time.

What the data says

For a clearer picture, let’s look at VTI’s mutual fund counterpart, which has been around since 1993. This longer history provides us with tangible evidence of what consistent investment in this fund could yield.

To illustrate, if an investor had placed $50,000 in the fund in 1993 and faithfully reinvested dividends every quarter, by March 2024, they’d have reached the milestone of $1 million. This achievement underscores not just the fund’s performance but the added growth from reinvesting dividends, which compounds the investment’s value over time.

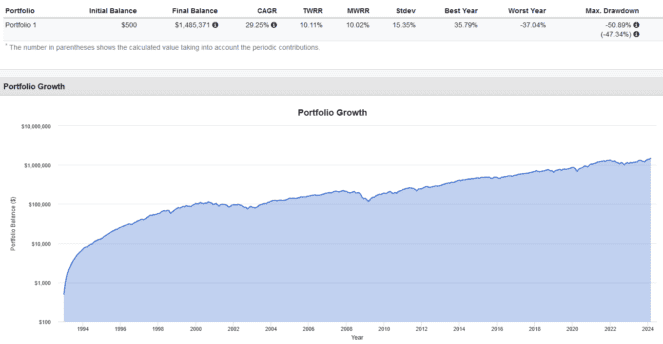

However, the story gets even more compelling when considering a strategy known as dollar-cost averaging. By starting with a $500 investment and continuing to invest $500 every month, an investor could have seen their investment grow to $1.4 million by 2024. This approach mitigates the risk of market volatility, as it spreads the investment over various market conditions, buying more shares when prices are low and fewer when prices are high.

The significant growth, especially after crossing the $100,000 mark, showcases the power of compounding and importance of timing in the market. Compounding accelerates the growth of an investment, as returns are earned on top of returns. And the more time your investment has to grow, the more significant the impact of compounding can become.

How to invest in VTI

VTI is particularly well-suited for investors who either have the means to convert currency at low cost or already have access to U.S. dollars, such as those who receive income in USD.

One key strategy for Canadian investors is to hold VTI within a Registered Retirement Savings Plan (RRSP). This approach is beneficial because it sidesteps the 15% foreign withholding tax on dividends that typically applies to Canadian investors holding U.S. securities.

But for those who prefer to invest in Canadian dollars or wish to avoid the complexities of currency conversion, an alternative is the Vanguard U.S. Total Market Index ETF (TSX: VUN).

This ETF provides similar exposure to the U.S. stock market as VTI but trades in Canadian dollars on the Toronto Stock Exchange. With an expense ratio of 0.16%, it offers a cost-effective way to gain comprehensive access to U.S. equities without managing U.S. currency.