For the record, I’m not one to chase hype, and currently, there’s no buzz bigger than artificial intelligence (AI). Honestly, I’m quite content with the AI exposure already baked into my S&P 500 index funds.

However, if you’re intent on tapping into the AI sector more directly, diving headfirst into individual semiconductor or software stocks might not be the safest approach.

Instead, consider the strategic use of thematic exchange-traded funds (ETFs). These can provide targeted AI exposure while mitigating risks associated with single-company volatility.

Today, I’ll introduce a solid AI-focused ETF from CI Global Asset Management that’s caught my eye, but I’ll also suggest a more conservative ETF to help balance out the inherent risks of sector-specific investing.

The AI ETF

Creating your own AI-themed portfolio involves a lot of work. You need to look into each company’s revenues to figure out just how much of their business is tied to or supports AI, not to mention the regular due diligence of stock picking.

Alternatively, you can simplify this task by investing in a thematic ETF like the CI Global Artificial Intelligence ETF (TSX:CIAI).

This ETF is actively managed by two finance experts who handle the stock picking and portfolio rebalancing for you. But despite being actively managed, CIAI is quite affordable with a management fee of just 0.20%.

The ETF is relatively new, so the Management Expense Ratio (MER) is still to be determined, but it has already gathered significant investor interest with $582 billion in assets under management – a strong start for a thematic ETF.

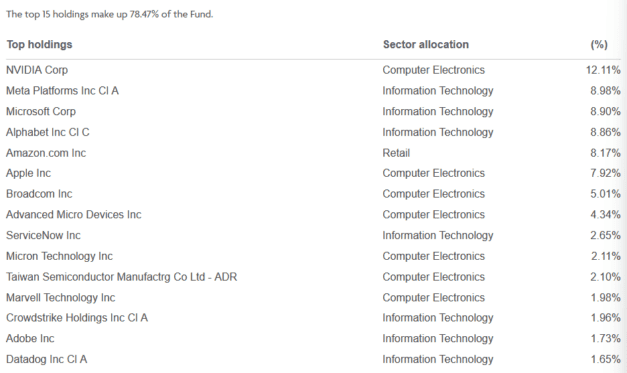

Here’s a snapshot of its top holdings as of July:

The safe ETF

While CIAI offers exciting exposure to the AI sector, it’s also rated as “high” risk by the fund manager. This indicates that its share price could experience significant fluctuations.

To counterbalance this volatility, it’s wise to maintain a portion of your portfolio in safer assets that can help you take advantage of any major dips in the market. While holding cash is one option, it doesn’t offer growth potential.

A strategic choice for keeping your funds secure while still earning returns is the CI High Interest Savings ETF (TSX:CSAV).

This ETF functions like a high-interest savings account but in ETF form, providing a net yield of 4.6% as of July 9th, with monthly distributions. It has a MER of 0.16%.