I’m not one to chase after the latest fads, and despite the current hype around artificial intelligence (AI), I remain a firm believer in low-cost index funds.

However, if you’re a Canadian investor eager to tap into the potential of AI stocks, there are a few approaches you might consider.

Whether you’re looking to directly own stocks or explore other avenues, I’ve got you covered with three main strategies to gain exposure to AI.

Option #1: Buy the U.S. stock

The simplest way to gain direct exposure to AI stocks is to invest in leading companies like Nvidia (NASDAQ:NVDA).

However, there’s a catch: Nvidia trades in U.S. dollars (USD), so you’ll need to convert your Canadian dollars (CAD) to USD. The cost of currency conversion varies with your brokerage, ranging from as low as $2 to as much as 1.5% of the transaction amount.

Another consideration is the dividend withholding tax. If you’re holding this stock outside of a Registered Retirement Savings Plan (RRSP), you’ll lose 15% of any dividends to U.S. withholding tax. While this might not significantly impact your returns—since many AI stocks offer low dividend yields—it’s still something to be aware of.

Option #2: Buy the CDR

If you prefer to avoid currency conversion costs or wish to invest directly in CAD, consider purchasing Canadian Depositary Receipts (CDRs).

CDRs allow Canadians to buy shares of U.S. companies priced per share in CAD and are adjusted for smaller investment sizes. They are currency-hedged to mitigate the impact of USD fluctuations on your returns.

However, currency hedging can incur a cost of up to 0.5% per year. Additionally, dividend withholding tax still applies.

Finally, it’s important to note that not all stocks are available as CDRs. You can check the current list of available CDRs here.

Option #3: Buy an ETF

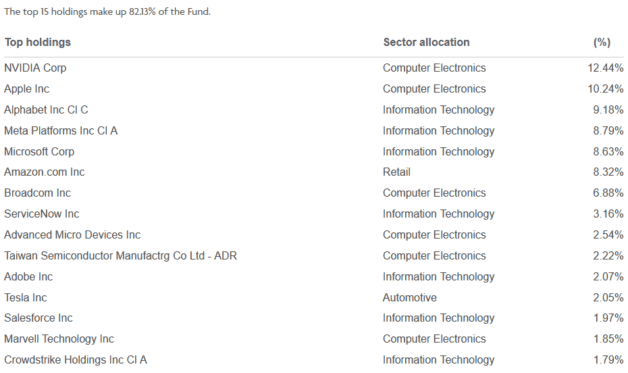

If you’re looking for a diversified and accessible way to invest in AI stocks, consider an exchange-traded fund (ETF). One excellent option is CI Global Artificial Intelligence ETF (TSX:CIAI).

This ETF is actively managed and charges a reasonable 0.2% management fee. It invests in a broad portfolio of global companies that are involved in AI, making it a well-rounded choice for exposure to this sector.

The fund is also quite popular, boasting over $574 million in assets under management. You can see its current top holdings below: