Contrary to its name, the Tax-Free Savings Account (TFSA) is more than just a place to save. If you’re only using it to hold cash, you’re wasting contribution room.

This flexible investment vehicle allows all kinds of earnings, from dividends to capital gains, to grow completely tax-free. And they can be withdrawn at any time without tax consequences.

Many investors use their TFSA for accelerating long-term investment growth, but it’s also powerful for creating tax-free passive income.

You can in fact use your TFSA to generate up to $6,000 annually, which breaks down to about $500 each month. One potential strategy is to invest in the Hamilton Enhanced U.S. Covered Call ETF (TSX:HYLD).

Here’s how it works and how much you’ll need to invest.

What is HYLD?

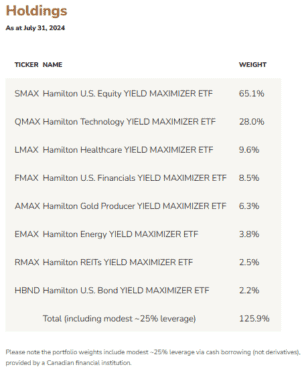

At the heart of HYLD is a collection of eight other Hamilton ETFs, each employing a covered call strategy. These ETFs are strategically allocated to reflect the sector makeup of the S&P 500.

In simple terms, the ETFs within HYLD sell (write) what are known as call options on their holdings. These options allow other investors to purchase stocks from the ETF at predetermined prices within a specified timeframe.

By selling these options, HYLD earns immediate income from the premiums paid by the buyers. However, this strategy caps the potential profits HYLD could make from stock price increases since it’s committed to selling at these predetermined lower prices.

Essentially, ETFs like HYLD exchange the possibility of future stock gains for more immediate income. This makes them attractive for those seeking regular income but less so for those looking for significant capital appreciation.

To further boost potential returns, HYLD utilizes leverage, borrowing up to 25% of its total assets to invest more heavily in its underlying ETFs. While this can magnify gains during market upswings, it also increases the risk and can intensify losses during downturns.

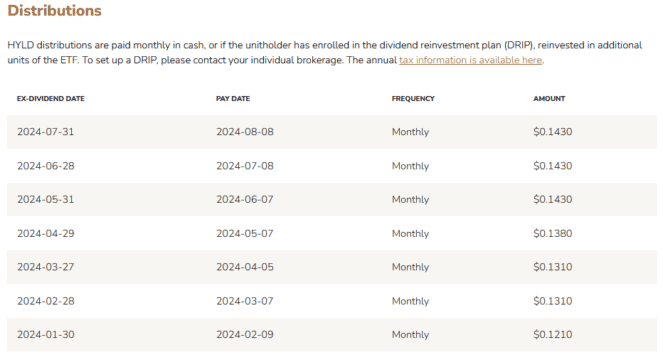

As of August 14th, HYLD provides a substantial yield of 12.6% – this is distributed on a monthly basis for an income-first approach.

How much do you need to invest?

Assuming HYLD’s most recent August monthly distribution of $0.1430 and the current share price at the time of writing of $13.33 remained consistent moving forward, an investor using a TFSA would need to buy roughly $46,615 worth of HDIV, corresponding to 3,497 shares to receive around $500 monthly tax-free.

| ETF | RECENT PRICE | NUMBER OF SHARES | DIVIDEND | TOTAL PAYOUT | FREQUENCY |

| HDIV | $13.33 | 3,497 | $0.1430 | $500.07 | Monthly |