Most Canadian stocks offer fairly tax-efficient returns due to the dividend tax credit and gross-up mechanism, but you’ll still forfeit a portion of your dividends to taxes.

If you’re looking to retain all your dividend earnings, placing your Canadian investments in a Tax-Free Savings Account (TFSA) is a good idea, unlike U.S. stocks, which are subject to a 15% withholding tax on their dividends.

For those new to dividend investing, starting with an exchange-traded fund (ETF) can simplify the process. Here’s a look at two ETFs ideal for a TFSA—one focused on high-yield dividends and the other on growth, both paying monthly income.

The dividend growth option

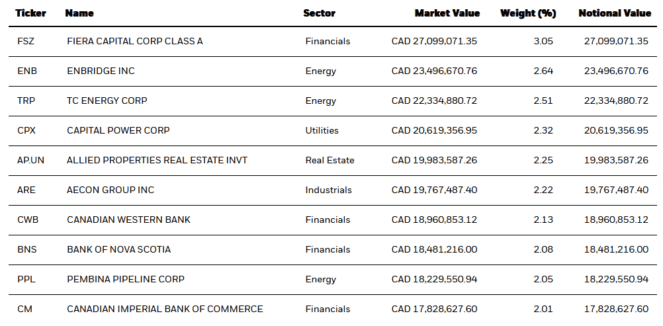

First up is iShares S&P/TSX Canadian Dividend Aristocrats Index ETF (TSX:CDZ), which targets Canadian dividend stocks that have consistently increased their dividends for at least five consecutive years.

While U.S. Dividend Aristocrats typically need a 25-year history of dividend growth, Canada’s smaller market size modifies this requirement to just five years.

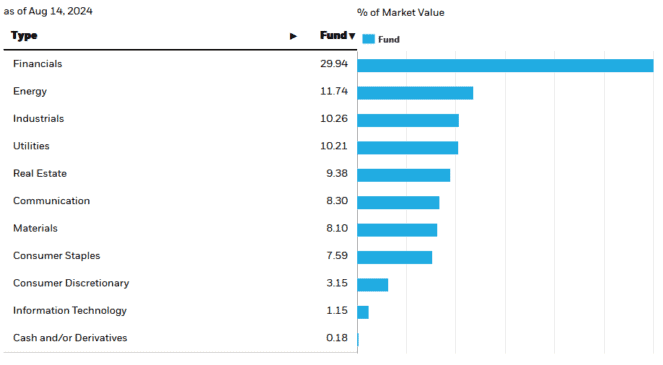

Currently, CDZ holds 91 stocks, primarily focused on the financial and energy sectors, which dominate the Canadian market. However, it also has meaningful allocations to industrials, utilities, real estate, and telecom sectors.

The emphasis on dividend growth means its yield is moderate but still attractive at 3.91% for the trailing 12 months.

The primary drawback of CDZ is its fee structure: a management expense ratio (MER) of 0.66% is on the higher side, particularly for a dividend-focused index ETF.

The high-yield dividend option

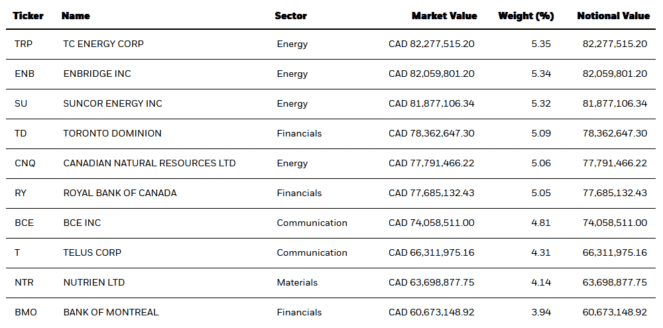

The alternative to CDZ for those seeking higher current yields is iShares S&P/TSX Composite High Dividend Index ETF (TSX:XEI).

Unlike CDZ, which focuses on dividend growth, XEI targets Canadian stocks that offer higher-than-average dividend yields. This allows the ETF to offer a robust 5.27% trailing 12-month yield.

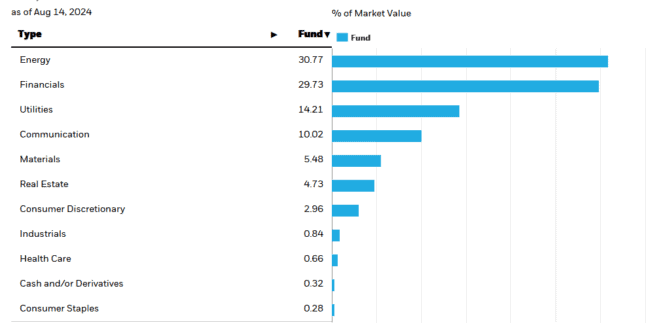

Currently, XEI manages a portfolio of 75 holdings, predominantly concentrated in the energy and financial sectors, with meaningful allocations to utilities and communications as well.

Adding to its appeal, XEI is also more cost-effective compared to CDZ, boasting a lower MER of just 0.22%.