Consider yourself lucky as a Canadian investor – our Tax-Free Savings Account (TFSA) offers flexibility and benefits that far exceed those of U.S. accounts like the Roth IRA, which comes with stricter withdrawal rules and penalties.

If you have TFSA room or spare cash to deploy, it’s crucial to make wise investment choices. Aim for assets that promise steady, long-term compounding rather than volatile, speculative investments like junior miners, penny stocks, or meme stocks.

To transform your TFSA into a true financial powerhouse with just $10,000, here are two exchange-traded funds (ETFs) that every Canadian investor should consider.

U.S. dividends

The first ETF I like for a core TFSA holding is the Vanguard U.S. Dividend Appreciation Index ETF (TSX:VGG).

Now, this ETF isn’t focused on providing a high dividend yield – it currently pays only 1.3%, which isn’t going to satisfy any income investors.

But if you’re skipping over VGG because of that low yield, you’re missing the bigger picture. Over the last 10 years, VGG has compounded at an impressive 13.7% with dividends reinvested. How? It’s all about the ETF’s methodology.

VGG tracks an index that screens for companies with at least 10 years of consecutive dividend growth. It then eliminates the top 25% highest-yielding stocks to avoid “yield traps” – companies that may offer high dividends but are at risk of cutting them.

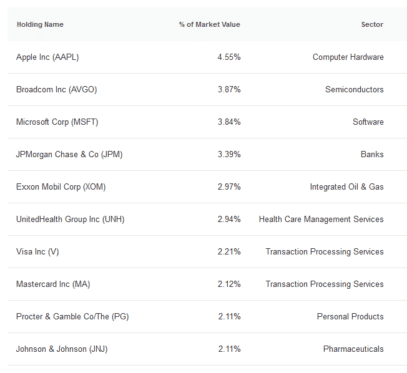

The result is a portfolio of just over 330 high-quality, blue-chip U.S. stocks, many of which you likely recognize.

Canadian dividends

I think the perfect complement to VGG in a TFSA is the Vanguard FTSE Canadian High Dividend Yield Index ETF (TSX:VDY).

Why pair them? Well, VGG focuses on U.S. dividend growth stocks, while VDY zeroes in on Canadian high dividend yield stocks. They go together like bread and butter.

VDY is ideal if you’re aiming for high tax-free dividend income – currently yielding 4.5%. This yield can be withdrawn tax-free from your TFSA for passive income, or reinvested to compound growth.

With dividends reinvested, VDY has returned an annualized 7.7% over the last 10 years, but has outperformed the S&P/TSX 60 Index since its inception.

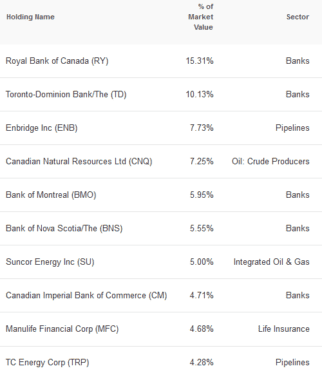

The top holdings in VDY’s portfolio are likely familiar to most Canadian investors – a robust collection of Canada’s largest banks, lifecos, and energy companies.