I love using Coca-Cola (NYSE:KO) as a perfect example of the power of a buy-and-hold mindset.

Imagine this: a single share purchased in 1919, thanks to numerous stock splits, could have grown into 9,216 shares today. On top of that, think about Coca-Cola’s impressive track record of increasing dividends for 62 consecutive years!

But let’s set Coca-Cola aside for a moment. Are there other blue-chip stocks that I consider slam-dunk candidates for a lifetime hold? Absolutely.

There are two more that come to mind, each characterized by below-average volatility (low beta), sterling credit ratings, and rock-solid balance sheets.

These are the kind of stocks you can buy now and hold forever, resting easy knowing your investment is secure.

Berkshire Hathaway

Warren Buffett has famously transformed Berkshire Hathaway (NYSE:BRK.B) from a struggling textile company into one of the most successful conglomerates in history.

This transformation wasn’t merely a shift in focus; it involved a strategic acquisition of an expansive portfolio of wholly-owned businesses, each integral to America’s economic fabric.

Notable holdings include the major railroad Burlington Northern Santa Fe, energy giant Berkshire Hathaway Energy, insurance heavyweight GEICO, and the well-known retail chain See’s Candies.

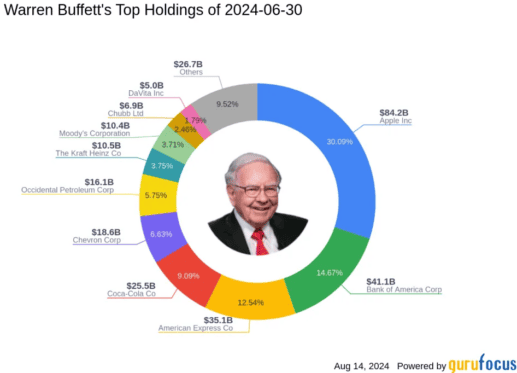

Additionally, under Buffett’s stewardship, Berkshire also holds a meticulously curated stock portfolio comprising some of America’s top companies.

What impresses me the most about Berkshire, however, is its ironclad balance sheet. With total cash (most recent quarter) standing at a colossal $276.94 billion versus a total debt of $123.63 billion, the financial foundation here is as solid as they come.

For shareholders, this represents a safe harbour, ensuring stability and financial security that can withstand economic turbulence.

Johnson & Johnson

Johnson & Johnson (NYSE:JNJ) has redefined itself as a pure-play pharmaceutical and medical device powerhouse after spinning off its consumer healthcare products into a separate entity.

This strategic pivot emphasizes its focus on sectors that are essential regardless of economic conditions, underlining its status as a defensive stock. With a low beta of 0.52, it demonstrates minimal volatility compared to the broader market, enhancing its appeal as a safe investment.

The company boasts an impressive 29.82% operating margin, providing substantial financial leeway to withstand economic downturns—essential for a company in the healthcare sector, where demand remains constant even in rough economic waters.

Moreover, Johnson & Johnson has increased its dividend for 61 consecutive years, showcasing its commitment to returning value to shareholders.

What truly sets Johnson & Johnson apart is its AAA credit rating, which is the highest possible mark and is a rarity among corporations.

This rating is even more notable considering that it surpasses the U.S. government’s own AA rating, underscoring the company’s exceptional financial health and stability.