With a few exceptions, most TSX-listed dividend stocks pay out quarterly. Those that do offer monthly dividends are often an assortment of lenders, real estate investment trusts, utilities, and, occasionally, energy companies.

However, there exists a special class of stock specifically designed to generate monthly passive income—the royalty trust.

Here’s a look at one of the most popular and best-performing royalty trusts and how much monthly income you could generate with a $10,000 investment.

What is a royalty trust, anyway?

Imagine you own a popular restaurant chain called McBurger Town. You decide to form a royalty trust where investors can buy shares.

In exchange for their investment, they receive a portion of the restaurant’s gross revenue—let’s say 5%—as a monthly payment. This structure is beneficial because it has low overhead costs.

Unlike owning the restaurants directly, which involves managing staff, inventory, and property, the trust simply collects a percentage of sales. This way, it can distribute most of that money back to shareholders as dividends.

So, a royalty trust essentially allows investors to earn income from the revenue of a business without having to deal with the day-to-day operations of that business.

Pizza Pizza

Pizza Pizza Royalty (TSX:PZA) is a real-world example that works similarly to our hypothetical McBurger Town.

This company profits from the revenues of over 750 Pizza Pizza restaurants across Canada, a brand you’re likely familiar with and have probably visited at least once since its inception in 1967.

Pizza Pizza Royalty capitalizes on these sales by distributing a set monthly dividend of $0.0775 per share, which, annualized, works out to $0.93.

The schedule is consistent: they declare a monthly dividend to shareholders of record at the end of each month and then distribute this dividend on the 15th of the following month.

So, when you invest in Pizza Pizza Royalty, you’re essentially earning a slice of the pie from every pizza sold, paid out in regular monthly dividends.

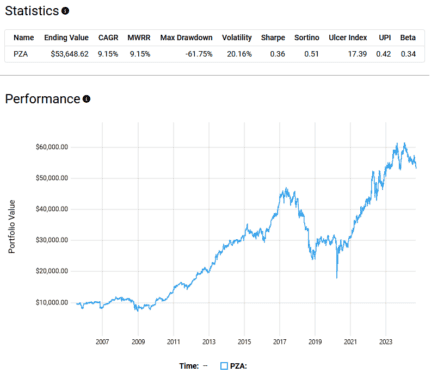

With dividends reinvested, an investment in Pizza Pizza Royalty from July 2005 to present would have compounded at an annualized 9.15%.

How much would $10,000 invested earn?

As of September 11, $10,000 would buy you 763 slices (pun intended) of Pizza Pizza Royalty at a price of $12.60 per share. At $0.0775 per share in dividends, you can expect to receive $59.1325 per month before taxes.

| Stock | RECENT PRICE | NUMBER OF SHARES | DIVIDEND | TOTAL PAYOUT | FREQUENCY |

| PZA | $12.60 | 763 | $0.0775 | $59.1325 | Monthly |