Forget the bi-weekly paycheck—real freedom comes from earning monthly, tax-free passive income generated by a diverse collection of profitable enterprises that consistently distribute dividends. This way, you earn money while you sleep.

You can achieve this level of financial independence with the right exchange-traded fund (ETF), a Tax-Free Savings Account (TFSA), and a starting capital of at least $50,000. Here’s how to set it up step by step and a calculation of how much you could be making.

Picking the right ETF

When I’m scouting for the ideal ETF to stock up in a TFSA for some steady passive income, I zero in on three must-haves:

- Low expense ratios: to keep more of what you earn.

- A high yield: ideally, something north of 4%.

- Solid diversification: to spread risk and enhance stability.

The ETF that ticks all these boxes for me is iShares Core MSCI Canadian Quality Dividend Index ETF (TSX:XDIV). It pays monthly, translating to an annualized distribution yield of 4.42% as of September 11.

This fund isn’t just chasing high yields or dividend growth; it’s also about quality. It targets companies with robust balance sheets and stable earnings.

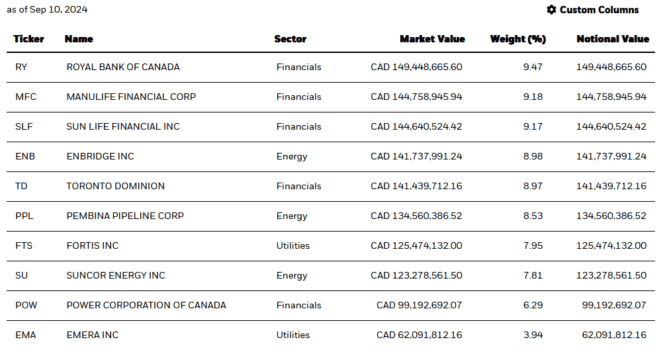

The portfolio comprises 19 of Canada’s most reliable blue-chip dividend payers, featuring stalwarts that you might already be familiar with.

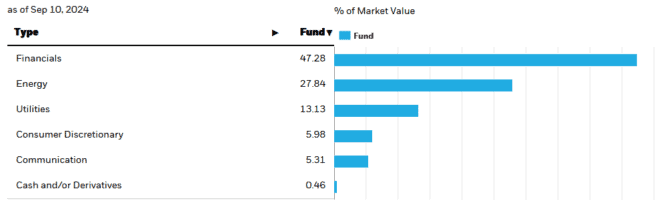

The majority of XDIV’s holdings are rooted in the sectors well-known for their dividend-paying capabilities: financials, energy, and utilities.

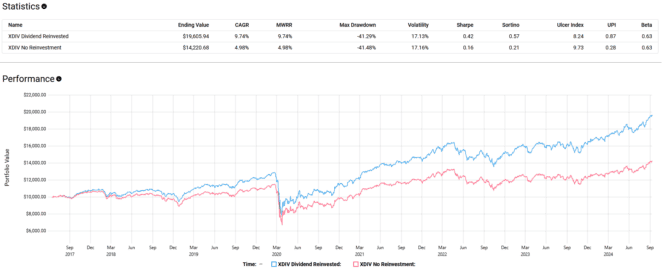

Historically, with dividends reinvested, XDIV has delivered an annualized return of 9.74% since its inception in June 2017. Even if you opted to withdraw the dividends, you’d have still seen a respectable annualized return of 4.98%.

How much passive income could you generate?

A $50,000 TFSA invested in XDIV would buy you 1,739 whole shares based on its September 11th price of $28.75. XDIV last paid out a monthly dividend of $0.106 per share on August 30. Assuming that remains consistent moving forward, your $50,000 worth of XDIV in a TFSA could generate around $184.33 per month in tax-free passive income.

| ETF | RECENT PRICE | NUMBER OF SHARES | DIVIDEND | TOTAL PAYOUT | FREQUENCY |

| XDIV | $28.75 | 1,739 | $0.106 | $184.33 | Monthly |