Sifting through exchange-traded funds (ETFs) for passive income can be rough — there are many options boasting high yields, but a closer look often reveals these payouts to be largely a return of capital, with underlying share prices that falter over the long term.

One notable exception stands out as a solid choice for sustainable income: the Vanguard FTSE Canadian High Dividend Yield Index ETF (TSX:VDY).

Here’s why this ETF is my top pick for anyone seeking a reliable long-term passive income generator.

It’s fairly affordable

Because it passively tracks an index, VDY manages to keep costs impressively low. At the time of writing, it charges a mere 0.22% management expense ratio (MER).

This means if you invest $10,000 in VDY, your annual fees amount to just about $22. That’s a small price to pay for the dividend income it offers!

It’s a dividend powerhouse

Speaking of dividends, VDY’s attractive 4.37% yield as of October 9 is a significant draw for income-seeking investors, but there’s more to appreciate here.

First, the dividends paid are qualified, meaning they may be eligible for the Canadian dividend tax credit, which is great news for tax-conscious investors.

Secondly, VDY pays out dividends monthly, not quarterly like most individual dividend stocks, allowing for a more consistent income stream which is ideal if you’re relying on this for regular expenses.

Lastly, the dividend itself has shown robust growth, increasing at an annualized rate of 8% over the last five years. This steady increase not only helps to combat inflation but also indicates the fund’s underlying health and performance.

VDY historical performance

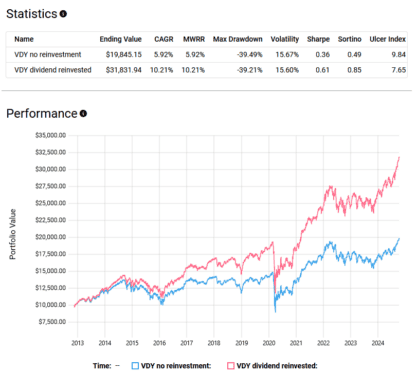

If you had invested $10,000 in VDY back on November 8, 2012, and consistently withdrew every dividend paid, your principal alone would have grown at an annualized rate of 5.92%, turning it into $19,845.15 by October 8, 2024.

This means you would have received decent monthly passive income while seeing your initial investment grow modestly. Now, let’s consider what would have happened if you had reinvested those dividends instead of withdrawing them.

In this scenario, your total investment would have compounded at an annualized rate of 10.21%, reaching $31,831.94.

This demonstrates why VDY is such an appealing option for me — it has historically provided sustainable, long-term income and attractive total returns at a low cost.

Even if you were drawing on the dividends for income, your investment would still have performed quite well, showcasing the fund’s ability to support both growth and income strategies.